Bitcoin on the Brink: The Journey to $100,000 and What It Means for Investors

As Bitcoin approaches the monumental $100,000 milestone, market sentiment is surging with a mix of excitement and speculation. News is swirling around President-elect Donald Trump’s newfound enthusiasm for cryptocurrency, signaling a potential shift in regulatory paradigms that could spell significant opportunities for investors in the coming months.

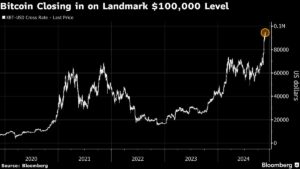

Just recently, Bitcoin reached an impressive peak of $97,892 before slightly retreating below the $97,000 mark. The broader crypto market has surged by an astonishing $900 billion following Trump’s election victory on November 5, highlighting a renewed investor confidence that is hard to ignore.

A Unique Turning Point for Crypto Regulation

Amid discussions within Trump’s transition team about establishing a dedicated digital-assets policy position within the White House, industry stakeholders are hopeful. This will be a groundbreaking move for the US, offering the crypto sector a direct communication line to the president-elect. Trump’s previous skepticism has turned into newfound support, an evolution largely propelled by significant investment from digital-asset firms during the election campaign. This shift could pave the way for a more supportive regulatory framework that encourages growth and innovation in the crypto landscape.

Demand Dynamics: Buyers Over Sellers

The market is currently witnessing an overwhelming demand for Bitcoin, with analysts like Tony Sycamore from IG Australia noting, “Buyers are strangling the sellers.” Even as Bitcoin edges closer to $100,000, there is a palpable sense of anticipation regarding what this psychological barrier could entail for market dynamics. Many advocates underscore the importance of this target, viewing it as a vital confirmation of Bitcoin’s role as a legitimate store of value in the modern economy.

Corporate Interest: MicroStrategy’s Bold Moves

Leading the charge in corporate investment is MicroStrategy Inc., which has publicly embraced Bitcoin. The company recently announced a nearly 50% increase in its planned issuance of convertible senior notes to $2.6 billion to fund further Bitcoin acquisitions. With a staggering $31 billion worth of Bitcoin in its treasury, MicroStrategy is transforming from a software company to a Bitcoin-centric firm. This transition serves as a powerful endorsement of the cryptocurrency’s potential and is likely to inspire other corporations to follow suit.

ETF Inflows: A Growing Trend

As Bitcoin’s price surges, a dozen US ETFs dedicated to Bitcoin have collectively attracted a staggering inflow of $5.8 billion since Election Day. This has propelled their total assets to an unprecedented $100 billion. The popularity of Bitcoin ETFs underscores a broader institutional acceptance of cryptocurrency, making it easier for investors to gain exposure to Bitcoin without directly holding the asset itself.

What’s Next?

The environment is ripe for volatility as Bitcoin traders anticipate the $100,000 milestone. Experts like Caroline Mauron, co-founder of Orbit Markets, describe this level as a “huge psychological milestone.” A bullish outlook dominates the discussions as many in the cryptocurrency space speculate that once Bitcoin crosses this threshold, it will not only bolster investor sentiment but will also potentially attract a new wave of market participants.

However, the crypto market is not without its shadows. The optimism surrounding the current rally has started to eclipse the significant downturn experienced in 2022, where issues surrounding fraud and risky practices led to the collapse of major exchanges like FTX. The expectation is that oversight and regulatory burdens intensified under the previous administration may ease, facilitating a more nurturing environment for innovation.

Conclusion

As Bitcoin inches closer to $100,000, all eyes remain glued to the market dynamics buoyed by regulatory optimism and corporate investments. The influence of prominent figures like Trump can create pivotal shifts that have lasting impacts on how cryptocurrencies are perceived and integrated into the financial ecosystem. For investors, understanding these dynamics is critical — this isn’t just about price points but about recognizing the broader implications for future growth in the cryptocurrency market.

Stay tuned with Extreme Investor Network for the latest insights and in-depth analysis of cryptocurrency trends and investments. Your journey toward informed investing continues here!