Bitcoin’s Roller Coaster: Analyzing Recent Market Trends and Insights

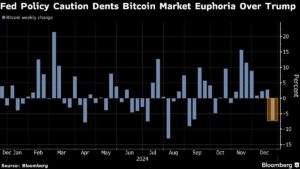

In recent weeks, Bitcoin has experienced significant volatility, culminating in its first weekly decline since the election of Donald Trump. Closing down approximately 7.5% over the past week, Bitcoin finds itself navigating uncharted waters amid a broader crypto landscape that’s equally tumultuous. As of now, Bitcoin is trading around $93,962 after plummeting as much as 2.8% earlier in the day. This decline follows a high of around $108,000, making the current slump particularly notable given the rapid pace of market shifts.

The Ripple Effect of Regulatory News

The crypto market is often influenced by regulatory signals, and the optimism surrounding Trump’s administration has been palpable. Support for a friendlier regulatory environment has led to rallies in various smaller tokens, including the likes of Ether and the ever-volatile Dogecoin, which saw gains of nearly 4%. However, concerns about sustained inflation and potential monetary policy tightening by the Federal Reserve have overshadowed this optimism, sparking uncertainty and fear among investors.

Recent announcements, particularly those involving committee assignments in Congress, have added another layer of complexity. With Senator-elect Bernie Moreno, known for his pro-crypto stance, joining the Banking Committee, some traders see potential for regulatory reform that could further stimulate the market.

Bitcoin’s Price Dynamics: Danger Below $90,000?

Market analysts are keenly watching Bitcoin’s performance as it clings to the significant psychological threshold of $90,000. Sean McNulty, director of trading at Arbelos Markets, warns that any drop below this level could trigger panic selling, leading to further liquidations. Additionally, a record outflow from U.S. exchange-traded funds investing directly in Bitcoin has raised alarm bells, suggesting that the current bearish sentiment may persist unless new positive news emerges.

Options market dynamics indicate heightened anxiety among traders, with increased activity in downside hedging for January, February, and March options with strike prices between $75,000 to $80,000. This behavior suggests a looming concern among large investors about potential downward pressure on prices.

Outlook: Short-Term Volatility with Long-Term Bullish Potential

Despite the current tumultuous landscape, there is reason for cautious optimism. David Lawant, head of research at crypto prime broker FalconX, believes that the market could witness a positive trajectory into the first quarter of 2025, despite short-term volatility. As we approach the end of the year, he notes that a “low-liquidity environment” could exacerbate price swings, especially with a massive options expiry event slated for December 27.

MicroStrategy: A Continued Commitment to Bitcoin

Investors should also take note of MicroStrategy Inc.’s continued accumulation of Bitcoin. The company recently announced its seventh consecutive week of Bitcoin purchases, acquiring 5,262 BTC at an average price of around $106,662. While the pace of their purchases has slowed as the Bitcoin price fluctuated, MicroStrategy’s ongoing investment signifies confidence in Bitcoin’s long-term potential.

Conclusion: Strategy Over Speculation

As Bitcoin and other cryptocurrencies navigate a challenging landscape, it’s crucial for investors to employ a strategic approach. Understanding the impact of macroeconomic factors, regulatory developments, and shifts in investor sentiment can provide a roadmap for navigating this volatile market. For committed investors, staying informed and maintaining a balanced perspective on risks and rewards will be key to capitalizing on future opportunities as the crypto market evolves.

Our community at Extreme Investor Network encourages readers to engage with these insights and stay ahead of the curve in the dynamic world of cryptocurrencies. For more detailed analyses and exclusive updates on market trends, make sure to explore our resources and join the conversation with fellow investors.