Bitcoin’s 2024 Uncertainty: What’s Next for the Leading Cryptocurrency?

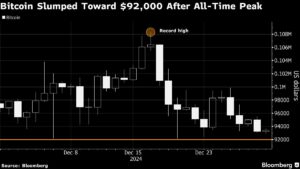

As we approach the end of 2024, Bitcoin’s price trajectory has left many investors pondering the future of this flagship cryptocurrency. While Bitcoin experienced a notable surge following the election of President Donald Trump in early November, the excitement appears to be waning. Currently hovering around the $94,000 mark, Bitcoin is roughly $14,000 shy of its all-time high, achieved in mid-December.

But what does this mean for investors? Several factors are influencing this stall in momentum.

Regulatory Landscape and Market Sentiment

One of the primary catalysts that initially propelled Bitcoin’s price was the anticipation of a more crypto-friendly regulatory environment under Trump’s administration. Unlike President Joe Biden, who pursued stricter regulations in the crypto sector, Trump has shown a preference for policies that are more accommodating to digital currencies. It’s expected that clarity on these regulations will come once Trump officially takes office on January 20.

This political backdrop has created a unique juxtaposition: while there is optimism tied to potential regulatory support, other elements are stifling market enthusiasm. One major concern is the Federal Reserve’s tone regarding interest rates. With speculation around interest rate cuts fading, the appetite for riskier assets like Bitcoin has diminished, leading to lower trading volumes and price stability.

Impacts of Recent Market Activity

In addition to regulatory shifts, market dynamics are changing. Research from Chris Weston, head of research at Pepperstone Group, highlights the erosion of momentum in Bitcoin’s post-election rally. He underscores that exchange-traded funds (ETFs) for Bitcoin have seen significant outflows—approximately $1.8 billion since December 19—which points to a cautious sentiment among institutional investors.

Interestingly, amid this backdrop of market uncertainty, MicroStrategy Inc., a software giant turned Bitcoin advocate, has continued its buying spree. The company currently holds over $40 billion worth of Bitcoin, and investors are keenly watching to see if MicroStrategy will maintain its trend of announcing significant purchases on Mondays.

Bitcoin’s 2023 Performance Comparison

Despite the recent price stagnation, we cannot overlook Bitcoin’s remarkable performance in 2023. The cryptocurrency has surged nearly 120% this year, outperforming traditional assets such as global stocks and gold. After a prolonged bear market, which many thought would define the crypto landscape, Bitcoin’s resurgence has reinvigorated its community and investment interest.

What Lies Ahead for Investors?

As the new year approaches, investors are left pondering several key questions: Will Bitcoin regain its upward momentum with the potential regulatory clarity expected from the Trump administration? Can MicroStrategy’s consistent purchasing inspire more institutional involvement? And how will broader economic conditions, particularly interest rates, continue to shape the cryptocurrency landscape?

For those entrenched in the market, it’s vital to stay updated on regulatory developments and market movements. The volatility and speculative nature of cryptocurrencies like Bitcoin demand a proactive approach to investment strategy. As always, diversifying your portfolio and maintaining a long-term vision can help navigate this unpredictable terrain.

In conclusion, while the current climate may seem ripe with uncertainty, Bitcoin’s historical performance and upcoming regulatory developments provide a glimmer of hope. For investors, understanding the nuances of these market forces will be essential in making informed decisions as we move into 2025. Stay tuned for continued updates and analysis from the Extreme Investor Network as we keep a close watch on this evolving story.