If you’re looking to understand the intricate world of economics and how interest rates play a crucial role, you’ve come to the right place. At Extreme Investor Network, we dive deep into the history of interest rates and provide unique insights that set us apart from the rest.

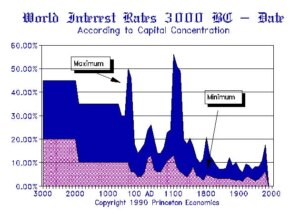

In a developed economy, interest rates reflect the expected decline in the purchasing power of money. This “option” value determines the rate at which individuals are willing to lend and borrow money. As expectations for profit increase, so do interest rates. On the other hand, in an undeveloped economy, lending is based primarily on the risk of repayment, often influenced by factors such as political stability and legal systems.

One fascinating aspect we explore is how interest rates vary across different regions, even within historical contexts like the Roman Empire. For instance, interest rates tend to be lower in stable economies like the United States and higher in riskier regions such as Greece. This disparity reflects the influence of political risk on lending practices, highlighting the interconnected nature of economics and governance.

When it comes to the Federal Reserve and quantitative easing (QE), our analysis reveals a paradigm shift in the relationship between money supply and inflation. Contrary to traditional beliefs, the Fed’s bond-buying activities did not necessarily increase the money supply or stimulate inflation as expected. Instead, the creation of excess reserves led to a complex interplay between bonds, cash deposits, and lending practices.

Furthermore, we shed light on the concept of velocity of money, a key indicator of economic activity and hoarding tendencies. As cash reserves grow and banks hold onto excess funds, we observe a deflationary trend that impacts asset values and investment decisions. This shift in dynamics signals a potential contraction in the economy, prompting governments to explore alternative solutions like electronic currency.

At Extreme Investor Network, we go beyond the surface to unravel the complexities of economics, interest rates, and monetary policies. Our unique insights and in-depth analysis offer a fresh perspective on the ever-evolving landscape of global finance. Join us as we navigate through the intricate web of economic trends and investment strategies, guiding you towards informed decision-making in an uncertain world.