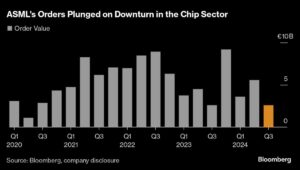

The recent plunge in ASML Holding NV’s shares shocked analysts and investors alike as the company reported only about half of the orders expected for the third quarter. Known for producing the world’s most advanced chipmaking machines, ASML’s bookings of €2.6 billion fell well short of the average estimate of €5.39 billion by analysts surveyed by Bloomberg. This unexpected slowdown resulted in ASML’s shares tumbling 16%, marking the largest decline in 26 years.

This news sent ripples throughout the semiconductor industry, with chip-related stocks like Nvidia Corp. and the Philadelphia Semiconductor Index experiencing significant drops as well. The broader downturn also affected makers of chip-manufacturing equipment, with companies like Applied Materials Inc., Lam Research Corp., and KLA Corp. all experiencing steep declines.

ASML attributed the weaker-than-expected results to a more gradual recovery than previously anticipated, leading to customer caution as the company revised its guidance for 2025. CEO Christophe Fouquet acknowledged the challenges, stating, “It now appears the recovery is more gradual than previously expected. This is expected to continue in 2025, which is leading to customer cautiousness.”

The situation was further complicated by ASML’s accidental premature release of its financial results, which were intended to be published a day later. The industry’s uneven performance was highlighted, with areas like artificial intelligence accelerators seeing high demand while other sectors, including automotive and industrial, faced a slump with customers reducing orders due to excess inventory.

Despite the challenges, Europe’s most valuable technology company remains heavily reliant on its sales to China, which accounted for 47% of the company’s revenue in the quarter. However, ongoing tensions between the US and China regarding semiconductor technology could pose risks for ASML in the future.

As investors analyze the impact of these developments on ASML’s outlook, industry experts are closely monitoring the company’s next steps and its ability to navigate the shifting dynamics within the semiconductor market. Extreme Investor Network will continue to provide updates and insights on ASML and other key players in the finance and technology sectors to help investors make informed decisions in these uncertain times.