Welcome to Extreme Investor Network, your go-to source for all things finance. Today, we are diving into the latest developments in the Asian stock market and how they can impact your investment decisions.

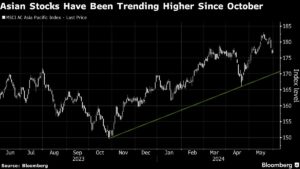

As reported by Bloomberg, Asian stocks saw gains in early trading, driven by a softer reading of the Federal Reserve’s preferred measure for inflation. This has boosted hopes for potential rate cuts in the future, making it an interesting time for investors to keep a close eye on the market trends.

In Australia and Japan, equities opened higher on Monday, with futures also pointing to gains in Hong Kong. Additionally, major emerging markets, such as India, are gearing up for elections, which could significantly impact stock prices, bond yields, and currency values. In Mexico, the peso was quoted higher as the polls remained open.

The recent gains in Asian shares were supported by positive signs of stabilization in China’s economy and a weaker dollar. However, political tensions in the Middle East and the upcoming US election could inject volatility into the market, according to AMP Ltd.

Looking ahead, traders will be closely monitoring inflation prints across emerging markets like Indonesia, South Korea, and Chile. Economic data releases in Australia and Europe, as well as the US jobs report on Friday, will also be key events to watch this week.

For more in-depth analysis and expert insights on the latest market developments, make sure to stay tuned to Extreme Investor Network. We provide unique perspectives and valuable information to help you make informed investment decisions and stay ahead of the curve in the ever-evolving world of finance.

Invest wisely and stay tuned for more updates from Extreme Investor Network. Remember, knowledge is power when it comes to investing!