Market Overview: Asian Equities Fall Amid Tariff Turbulence

In the latest market updates, Asian equities experienced a notable decline on Friday, following a tumultuous trading session on Wall Street. As uncertainties surrounding tariff negotiations continued to circulate, investors reacted with caution, resulting in decreased stock prices across the board.

Market Reactions in Asia

At the onset of trading, shares in Australia and Japan each fell by over 1%. Hong Kong’s equity index futures also exhibited a downward trend. The significant drop in Japanese benchmarks was largely attributed to a declining risk sentiment and a strengthening yen on Thursday, which unsettled investors.

On the U.S. front, the S&P 500 index dipped by 1.8%, and the Nasdaq 100 plummeted by 2.8%, placing the tech-heavy index on the verge of a technical correction. However, US futures showed signs of recovery after Broadcom Inc.’s optimistic revenue forecast provided a glimmer of hope. The chipmaker reassured the market with insights on sustained spending in artificial intelligence computing, causing its shares to soar by approximately 15% during after-hours trading.

Tariff Impacts and Investor Sentiment

The delays in tariff levies on Mexican and Canadian goods, as announced by President Trump, were expected to buoy the market, yet the anticipated rebound failed to materialize during regular trading hours. Chris Larkin of E*Trade highlighted that "trade policy is dominating market action," indicating that until there’s clarity on tariffs, volatility is likely to persist for traders and investors alike.

Furthermore, the after-hours rally stemmed primarily from tech companies, including Nvidia Corp. and Marvell Technology Inc., both of which faced drastic declines earlier. Their late recovery showcased how sensitive the market remains to external signals and earnings forecasts.

Economic Indicators and Future Insights

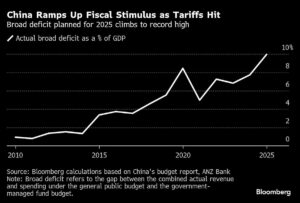

In a more global context, Chinese Finance Minister Lan Fo’an reassured that the government possesses ample fiscal policy tools to handle both domestic and external challenges. The People’s Bank of China reiterated plans for a moderately loose monetary policy, including potential interest rate cuts and adjustments to reserve requirements.

Looking ahead, traders and investors eagerly anticipate Friday’s nonfarm payrolls data, which could provide critical insights into the labor market’s health and its implications for interest rates. The Bureau of Labor Statistics report is set to offer an update that might influence Federal Reserve policymakers during their upcoming meeting on March 18-19.

Fed Chair Jerome Powell’s keynote speech at a monetary policy forum on Friday is expected to provide crucial insight into the central bank’s outlook, particularly as they assess labor market strength amid changing government policies.

Stocks, Currencies, and Commodities: A Snapshot

-

Equities:

- S&P 500 futures +0.3%

- Hang Seng futures -1.3%

- Japan’s Topix -1.9%

- Australia’s S&P/ASX 200 -1.3%

-

Currencies:

- Bloomberg Dollar Spot Index stable

- Euro at $1.0791

- Japanese yen steady at 147.96 per dollar

-

Cryptocurrencies:

- Bitcoin +0.2% to $90,006.96

- Ether -0.4% to $2,205.37

-

Bonds:

- 10-year Treasury yield unchanged at 4.28%

- Commodities:

- West Texas Intermediate crude showed a slight uptick, settled above $66 per barrel.

Key Upcoming Events

As the financial landscape evolves, keep an eye on pivotal events that could sway the market:

- Eurozone GDP report (Friday)

- U.S. jobs report (Friday)

- Fed Chair Jerome Powell’s address in New York (Friday)

- Speeches from various Federal Reserve officials (Friday)

In conclusion, the confluence of geopolitical tensions, tariff uncertainties, and critical economic data is creating a complex environment for traders and investors. Staying informed and agile is key as we navigate through these turbulent waters. Make sure to follow our updates and analyses at Extreme Investor Network to remain at the forefront of market developments.