Asia is bracing for a potential downturn in stocks as worries mount over the state of the Chinese economy. Meanwhile, US equity futures are holding steady, setting the stage for a cautious start to the trading week.

While Australian, Hong Kong, and mainland Chinese markets are signaling a possible early decline on Monday, trading activity in Asia could face added pressure due to thin liquidity with Japanese markets observing a public holiday. The S&P 500 wrapped up last week with a 0.2% dip following a quarterly options expiry.

Late data from Friday painted a bleak picture, revealing that Chinese governments have slashed spending and the youth jobless rate has hit its peak for the year, all while the nation’s banks are refraining from cutting lending rates. Adding to the gloomy sentiment, reports suggest that the US is gearing up to introduce rules that would prohibit Chinese hardware and software for connected vehicles as soon as Monday.

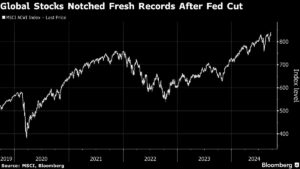

“Things in China are going from bad to worse,” remarked Tony Sycamore, an analyst at IG in Sydney, citing the closure of Japanese stock markets, the disappointing performance of the PBOC on Friday, and the escalating US yields. As we step into the final quarter, all eyes are on the Federal Reserve’s recent interest rate cut cycle, which has fueled gains across various asset classes from Indonesian bonds to gold. The upcoming week’s data, including the Fed’s preferred inflation measure, will likely determine the course of the rally, with the possibility of another 50 basis point cut looming if conditions deteriorate.

Following a seesaw session last Friday, where the S&P 500 and Nasdaq 100 ended lower after hitting new records, investors are adjusting to the latest market developments. Gold prices surged above $2,600 an ounce due to geopolitical tensions in the Middle East, while oil prices remained stable amidst retaliatory attacks in the region.

In the currency markets, the dollar is holding steady against major rivals as Asian trading hours commence, with US Treasuries market closed due to Japan’s holiday. Australian bonds are sliding ahead of the central bank’s anticipated decision to maintain its policy stance, amid concerns surrounding housing costs and persistent inflation.

Looking ahead, economic indicators from Europe, including factory activity and consumer confidence data, are eagerly anticipated, along with inflation figures from Australia and Tokyo. A slew of Fed speakers are scheduled to provide insights, alongside key economic releases such as the US personal consumption expenditures gauge and jobless claims data.

As the global financial landscape continues to evolve, investors will closely monitor a series of events this week, including:

– Malaysia CPI (Monday)

– Eurozone HCOB Manufacturing PMI, HCOB Services PMI (Monday)

– UK S&P Global Manufacturing PMI, S&P Global Services PMI (Monday)

– Australia rate decision (Tuesday)

– Japan Jibun Bank Manufacturing PMI, Services PMI (Tuesday)

– Mexico CPI (Tuesday)

– Bank of Canada Governor Tiff Macklem speaks (Tuesday)

– Australia CPI (Wednesday)

– China medium-term lending facility rate (Wednesday)

– Sweden rate decision (Wednesday)

– Switzerland rate decision (Thursday)

– ECB President Christine Lagarde speaks (Thursday)

– US jobless claims, durable goods, revised GDP (Thursday)

– Fed Chair Jerome Powell gives pre-recorded remarks (Thursday)

– Mexico rate decision (Thursday)

– Japan Tokyo CPI (Friday)

– China industrial profits (Friday)

– Eurozone consumer confidence (Friday)

– US PCE, University of Michigan consumer sentiment (Friday)

As trading activity kicks off for the week, some of the notable market moves include:

Stocks:

– S&P 500 futures are flat

– Hang Seng futures are down 0.5%

– S&P/ASX 200 futures are down 0.8%

Currencies:

– The Bloomberg Dollar Spot Index remains unchanged

– The euro is stable at $1.1163

– The Japanese yen sits at 143.82 per dollar

– The offshore yuan hovers around 7.0442 per dollar

– The Australian dollar steadies at $0.6806

Cryptocurrencies:

– Bitcoin climbs 0.4% to $63,486.59

– Ether gains 0.1% to $2,576.21

Bonds and commodities movements are also closely watched, painting a dynamic picture of the current financial landscape. Stay tuned for more updates and analysis on market trends and developments as they unfold.

This content was curated in association with Bloomberg Automation.

– Extreme Investor Network