Welcome to Extreme Investor Network, where we provide you with exclusive insights and updates on the latest developments in the world of finance. Today, we are diving into the recent earnings report from Applied Materials Inc., the largest US maker of chipmaking machinery, and breaking down what it means for investors.

Applied Materials Inc. recently announced its fiscal third-quarter sales forecast, projecting revenue of around $6.65 billion. While this figure surpassed the average Wall Street estimate, some analysts had anticipated even higher revenue numbers, with projections reaching as high as $7.13 billion. Additionally, the company expects a profit of $1.83 to $2.19 per share, excluding certain items, for the upcoming three-month period ending in July. This forecast falls slightly below analysts’ consensus estimate of $1.98 per share.

Investors have been closely monitoring Applied Materials for signs of a chip recovery, as the company serves as a key supplier to major manufacturers such as Taiwan Semiconductor Manufacturing Co., Samsung Electronics Co., and Intel Corp. Therefore, its outlook serves as a vital indicator of demand trends within the electronics supply chain.

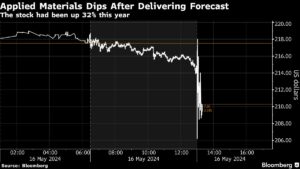

Despite the positive sales forecast, Applied Materials’ shares dipped 1.5% in extended trading, following a 32% increase in stock value so far this year. The company highlighted the growing demand for machines utilized in the production of artificial intelligence processors, but noted that some customers are pausing orders for semiconductor equipment used in various industries while they integrate previously purchased machinery.

In a recent phone interview, CEO Gary Dickerson expressed optimism regarding the future of AI-related chips, predicting that they will soon surpass smartphones and personal computers in silicon consumption. With China accounting for 43% of the company’s revenue last quarter, Applied Materials is also benefiting from significant investments by Chinese companies in semiconductor manufacturing.

However, concerns linger among investors regarding geopolitical tensions and potential restrictions on exports to China. While US companies are prohibited from supplying advanced manufacturing equipment to China, they are experiencing a surge in orders for equipment used in producing simpler types of chips. This rapid increase in orders from China has raised fears that political tensions could disrupt future growth opportunities for Applied Materials and other companies in the industry.

At Extreme Investor Network, we keep a close eye on market trends and provide our readers with exclusive analysis and insights to help them navigate the complex world of finance. Stay tuned for more updates and expert commentary on the latest developments in the financial markets.

Remember to visit our website for more in-depth analysis and unique perspectives on the world of finance. Thank you for joining us at Extreme Investor Network, where we turn complex financial information into valuable insights for our readers. Happy investing!