Apple: Once a Safe Haven, Now Facing Stormy Seas

For years, Apple Inc. was heralded as a reliable investment safe haven during turbulent market conditions. However, the latest downturn in the stock has shattered that notion and raised alarm bells among investors.

A Year of Underperformance

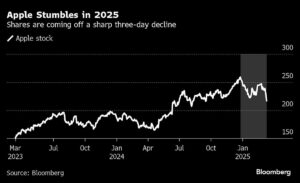

Apple’s stock has seen a sharp decline, dropping 14% this year alone, with recent trading sessions marking its most significant three-day slump since November 2022. This downturn comes as the broader Nasdaq 100 Index has also experienced a dip, down 7% this year, with Apple being a substantial contributor to this decline. The question on many investors’ minds is: how did this once-golden stock tarnish so quickly?

Risks on the Radar

The risks facing Apple are multifold, casting shadows over its historically robust market position. The tech giant faces significant tariff uncertainties and geopolitical tensions, particularly regarding its heavy dependence on China. Approximately 17% of Apple’s revenue for fiscal 2024 is expected to come from the Greater China region. The potential for increased tariffs—just recently elevated to 20% by the Trump administration—could lead to a meaningful reduction in operating margins and sales growth, according to Bloomberg Intelligence analyst Anurag Rana.

Apple’s recent attempts to leverage artificial intelligence have also fallen short, as the company delayed the rollout of its AI-infused Siri digital assistant, raising questions about its innovation pipeline. This has left many investors feeling slighted and wary of the company’s ability to drive future growth amidst fierce competition.

Premium Valuation Amid Slow Growth

Despite these challenges, Apple continues to trade at a premium—28 times estimated earnings—well above its 10-year average and higher than other large-cap tech stocks. This valuation raises eyebrows, particularly when considering that revenue has been stagnant, with five out of the last nine quarters reporting declines. Analysts expect growth in fiscal 2025 to be around 4.7%, significantly below the broader tech sector’s anticipated rate of 11.8%. This divergence poses an investment conundrum for potential buyers.

Analyst Sentiments

Investor sentiment toward Apple has notably cooled, with fewer than two-thirds of analysts recommending a buy. Tim Ghriskey, a senior portfolio strategist, mentions that while Apple historically has been a go-to stock for investors seeking safety, the high valuation and lack of growth catalysts are dissuading new investments. Scott Yuschak, managing director of equity strategy at Truist Advisory Services, echoed a similar sentiment. While he doesn’t see Apple as a primary concern due to its strong balance sheet, the mounting risks and valuation hurdles cannot be ignored.

A Silver Lining?

Amidst the bleak outlook, there are rays of hope. Apple’s partnership with Alibaba to integrate AI technology into its products in China might pave the way for enhancing its AI capabilities. Furthermore, experts posit that while Apple may not be a high-octane growth stock, its quality earnings and resilient balance sheet might provide a degree of safety in a cooling economy.

Ed Cofrancesco, CEO of International Assets Advisory, emphasizes that while Apple isn’t the stock to watch for explosive growth, it has shown resilience in the past and may continue to do so in the face of challenges.

Conclusion

While Apple Inc. has traditionally been seen as a steadfast investment, evolving market dynamics and conspicuous risks are making the case for investing in the tech giant increasingly complex. As investors look towards future growth opportunities, the critical lesson here is to stay informed and evaluate potential investments against the backdrop of changing economic conditions. For those in search of quality and stability, Apple may still hold appeal, but discerning investors should tread carefully, keeping an eye on the numerous "land mines" ahead in the tech landscape.

At Extreme Investor Network, we believe timely and informed insights are essential for navigating today’s complex financial markets. Stay updated with us to ensure you make investment decisions backed by thorough analysis and expert perspectives.