As we enter October, the financial world is buzzing with anticipation as Federal Reserve policymakers contemplate another interest-rate cut. The upcoming week promises key events that will shed light on the US economic outlook and potentially shape the Fed’s decision-making process.

Fed Chair Jerome Powell is scheduled to address economists at the National Association for Business Economics conference on Monday, offering insights into the state of the US economy. Later in the week, all eyes will be on the release of the September jobs report, which is expected to reflect steady job growth in the US.

Economists predict a rise of 146,000 payrolls for September, maintaining a similar pace to the previous month. The jobless rate is forecasted to hold at 4.2%, with average hourly earnings projected to have increased by 3.8% from a year earlier.

However, recent labor unrest, such as strikes by Boeing Co. factory workers and threatenings strikes by dockworkers, adds a layer of complexity to the labor market data. This upcoming jobs report may be the last clear snapshot before Fed policymakers convene in early November.

In addition to the monthly payrolls report, industry surveys will provide further insights into private-sector hiring trends. The Institute for Supply Management will release its manufacturing survey, followed by the services index, both of which include employment measures.

Meanwhile, in Canada, data on home sales in major cities like Toronto, Calgary, and Vancouver will offer a glimpse into the real estate landscape following recent rate cuts by the central bank.

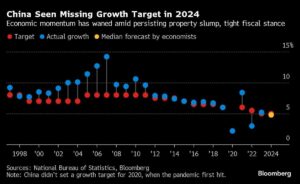

On the global stage, data from various regions is expected to reflect slowing inflation trends. Asian markets will be closely watching China’s manufacturing PMI figures, as well as key economic indicators from Indonesia, Malaysia, Thailand, Taiwan, Vietnam, and the Philippines.

Europe is set to take center stage with crucial inflation reports from major economies like Germany, Italy, and Spain. The European Central Bank’s upcoming decisions regarding monetary policy will also be closely monitored by investors and economists alike.

As we navigate through the economic landscape in the month ahead, stay tuned for updates on monetary decisions in regions like Latin America and Africa, where central banks are weighing their options in response to evolving economic conditions.

At Extreme Investor Network, we aim to provide our readers with comprehensive and insightful analysis of the latest financial developments. Stay informed and stay ahead of the curve with our unique take on the world of finance.