Unlocking the Potential of AI Stocks: Nvidia vs. Amazon

The technology sector is currently experiencing a renaissance, driven by breakthroughs in artificial intelligence (AI) that have captured the attention of investors. Among the top AI opportunities are a select group of megacap tech companies known as the “Magnificent Seven.” Over the past year and a half, semiconductor company Nvidia (NASDAQ: NVDA) has seen a remarkable 628% return, outpacing its peers in the Magnificent Seven.

While Nvidia continues to play a significant role in the AI revolution with strong near-term prospects, its long-term outlook is a topic of discussion. In comparison, Amazon (NASDAQ: AMZN) emerges as a compelling investment opportunity among the Magnificent Seven peers. Let’s delve into the reasons behind Nvidia’s current success and explore why Amazon could be the superior investment choice.

The Rise of Nvidia: Supercharged, Yet Facing Competition

Generative AI applications, like machine learning and accelerated computing, rely on key components such as graphics processing units (GPUs) and data center network services. Nvidia currently holds a dominant position at the intersection of GPUs and data center operations, capturing an estimated 80% of the AI chip market.

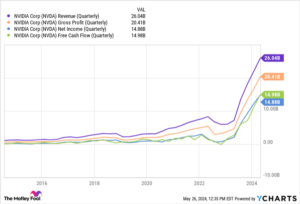

This lead has translated into record revenue, margins, and cash flow for Nvidia, as illustrated in the revenue chart above. However, competitors like Advanced Micro Devices and Intel are developing alternative GPUs, posing a challenge to Nvidia’s market share in the long run.

Moreover, Nvidia faces additional competition from tech giants like Meta Platforms and Amazon, who are investing in internally developed chips to reduce reliance on Nvidia. Though the transition from Nvidia may not happen soon, the competitive landscape and evolving customer demands suggest potential shifts in the future.

Amazon: A Diversified Giant Poised for AI Integration

While Amazon is renowned for its e-commerce marketplace and cloud computing services through AWS, the company boasts diverse revenue streams in streaming, grocery delivery, and advertising. Amazon’s ecosystem presents a unique opportunity to leverage AI across its operations for enhanced growth.

Amazon’s strategic investments in AI, such as the collaboration with AI startup Anthropic and the commitment to building data centers, signify the company’s readiness to move away from Nvidia in the long term. This forward-thinking approach positions Amazon as a promising player in the AI landscape.

Looking Ahead: Amazon vs. Nvidia

Both Nvidia and Amazon exhibit strong financial positions and compelling investment prospects. However, the disparity between valuation multiples suggests that Amazon may offer more value at the current stage. Amazon’s diversified business model and emphasis on AI integration lay a solid foundation for sustained growth.

As Nvidia faces competition and potential market shifts, Amazon’s strategic focus on AI provides a pathway for long-term success. In conclusion, while both companies present investment opportunities, Amazon’s trajectory in the AI realm and overall financial stability make it a promising choice for investors.

For more expert insights on AI stocks and investment strategies, stay tuned to Extreme Investor Network for exclusive content and analysis.