Amazon Faces Capacity Constraints Amidst Ambitious AI Investments

Amazon.com Inc. has issued a cautionary note to investors, indicating potential capacity constraints within its cloud computing division, Amazon Web Services (AWS). This comes despite plans to invest an impressive $100 billion this year, primarily focused on expanding data centers, developing in-house chips, and enhancing equipment to cater to the burgeoning demand for artificial intelligence (AI) services.

Aiming to be the AI Supermarket

CEO Andy Jassy is committed to transforming Amazon into an AI powerhouse, often referred to as an "AI supermarket." However, he acknowledged that AWS’s growth trajectory may not be smooth sailing. Jassy pointed out that factors such as delayed hardware procurement and insufficient electricity supply could negatively impact AWS’s expansion. “It is true we could be growing faster were it not for some of the constraints on capacity,” he remarked during a recent earnings call.

This isn’t an isolated challenge; even tech giant Microsoft highlighted similar hurdles last week, revealing that its cloud sales growth is being hampered by a shortage of data centers to meet the soaring demand for its AI offerings.

Navigating Supply Chain Pressures

Jassy further elaborated on the supply chain issues hindering AWS’s potential. The availability of crucial components, including chips from third-party suppliers and Amazon’s own design units, along with power limitations, are cited as bottlenecks for bringing new data centers online. Optimistically, he suggested that these constraints might ease by the latter half of 2025.

In line with these challenges, Amazon has ramped up its capital expenditures, spending $26.3 billion in the final months of 2024. The majority of this investment was channeled into AI-focused projects within AWS. Jassy indicated that this expenditure is indicative of the company’s spending trajectory expected in 2025.

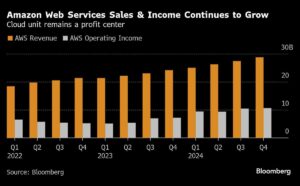

Revenue Growth Amid Constraints

Despite these limitations, AWS achieved a 19% revenue increase, totaling $28.8 billion for the fourth quarter, marking the third consecutive quarter of such growth. Operating income from this division hit $10.6 billion, surpassing analysts’ expectations. However, some analysts, like Sky Canaves from Emarketer, note that the rate of growth did not accelerate as previously anticipated, revealing that Amazon is grappling with similar capacity issues as its competitors, including Google and Microsoft.

Interestingly, Jassy’s warnings about AWS’s growth constraints seemed to overshadow an otherwise robust holiday quarter for Amazon’s core e-commerce and logistics operations, which are currently facing stiff competition from Walmart and up-and-coming discount retailers like Temu and Shein.

Stock Market Reactions and Future Projections

Following the earnings report, Amazon’s stock experienced a 4% decline during extended trading hours after closing at $238.83. The stock has seen an impressive 8.9% gain so far in 2025, building on a remarkable 44% surge in 2024. However, the ongoing AI race could pressure profits moving forward, with Amazon projecting an operating income of between $14 billion and $18 billion for the period ending in March, slightly below analysts’ expectations of $18.2 billion.

Investors are keeping a close eye on the first-quarter sales outlook, which could max out at $155.5 billion, again falling short of the average analyst estimate of $158.6 billion.

Conclusion: A Balancing Act

Amazon’s fourth-quarter performance brought some positives, with total revenue climbing 10% to $187.8 billion, exceeding analyst estimates. Operating profits also outpaced expectations, reaching $21.2 billion compared to forecasts of $18.8 billion. Moreover, total operating expenses rose by 6.2% to $166.6 billion, illustrating a trend where revenue growth continues to outpace cost increases for the eighth consecutive quarter. As of the end of the quarter, Amazon employed over 1.55 million full- and part-time workers, reflecting a 2% increase from the previous year.

For investors and stakeholders, the road ahead for Amazon is undoubtedly complex, marked by both impressive growth and considerable challenges. The emphasis on AI and cloud computing not only illustrates Amazon’s strategic vision but also its need to address supply chain limitations and optimize resource allocation. As the tech landscape evolves, how Amazon navigates these growth constraints will be crucial in solidifying its position as a leader in both e-commerce and cloud services.

Stay tuned for updates on Amazon’s journey to the forefront of AI and cloud computing, right here at Extreme Investor Network!