Is Google’s Investment in AI Paying Off? An In-Depth Analysis of Alphabet’s Q4 Performance

In a surprising turn of events, Google’s parent company, Alphabet Inc., reported fourth-quarter revenue that fell short of analysts’ expectations, stirring concerns among investors. This underperformance is particularly notable given the growing focus on artificial intelligence (AI) and its anticipated impact on the tech giant’s future.

Revenue Insights

For the quarter, Alphabet announced sales of $81.6 billion, falling short of the projected $82.8 billion. In reaction to the disappointing figures, Alphabet’s shares dropped by more than 9% in after-hours trading. However, a silver lining in Alphabet’s report reveals net income was pegged at $2.15 per share, marginally exceeding the analyst estimate of $2.13 per share.

The company has plans to significantly ramp up capital expenditures, projecting $75 billion in spending for 2025—outstripping the expected $57.9 billion. CEO Sundar Pichai emphasized that these investments are crucial for enhancing customer services and driving revenue growth.

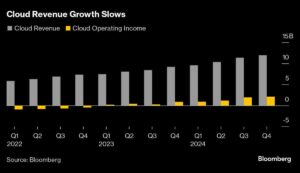

The Cloud Conundrum

Alphabet’s cloud division has emerged as a key barometer for measuring the impact of the burgeoning AI market. Although there has been a noticeable influx of startups seeking services that demand substantial computing power, growth has not matched expectations. The cloud division reported sales of approximately $12 billion for the quarter, which was below estimates.

Competition remains fierce, with Google Cloud lagging behind industry titans Amazon Web Services and Microsoft Azure. Pichai acknowledged the necessity for continued investment in cloud infrastructure to meet rising customer demand.

Investors on Edge

The sentiment among investors is one of skepticism as Alphabet is urged to demonstrate the tangible benefits of its hefty investments in AI. The recent emergence of Chinese AI startup DeepSeek—a company that claims to have developed a powerful AI model at a fraction of the cost of U.S. counterparts—has particularly heightened concerns. Analysts warn that Google’s competitive advantages in AI and core search capabilities could be diluted if the company fails to keep pace with innovation and cost-effectiveness.

As Dan Morgan, a senior portfolio manager at Synovus Trust, pointedly remarked, the real winners in the AI boom may not be model developers like Google, but rather the firms specializing in the hardware necessary for AI applications. "You want to be the supplier, not the miner," he said, highlighting a potential shift in profit centers within the tech industry.

Quick Snapshot of Business Units

Alphabet’s advertising sector remains the cornerstone of its revenue. The search advertising unit generated $54 billion, slightly exceeding expectations, but facing new threats from both AI competitors and ongoing antitrust scrutiny. A recent ruling found that Google monopolized the search market, and legal challenges are expected to conclude by 2025.

Meanwhile, YouTube, a critical component of Alphabet’s ecosystem, surpassed revenue expectations with $10.5 billion, driven by increasing podcast popularity during the U.S. election cycle—a strategic early investment that is now paying off.

On a different note, Alphabet’s “Other Bets,” which encompass companies like Verily and Waymo, reported revenues of $400 million—significantly below expectations of $592 million. While Waymo is expanding its testing to 10 new cities and averaging 150,000 trips weekly, its struggle to generate substantial revenue remains a topic of concern for investors.

Conclusion: Future Prospects

The road ahead for Alphabet is fraught with challenges as it attempts to balance its heavy investments in AI with the need to prove their value through actual revenue gains. In an increasingly competitive landscape, how Alphabet crafts its narrative and proves its strengths will determine its trajectory.

As we approach 2025, with major court rulings and anticipated advancements in AI technologies, all eyes will be on Google. Interested investors and tech enthusiasts should keep a close watch on how these factors unfold and influence the company’s market position.

Stay tuned to Extreme Investor Network for more insights and analysis on the evolving financial landscape and how major players like Alphabet are navigating these changes.