Alibaba’s Upcoming Hong Kong Listing: A Game-Changer for Investors

Chinese investors are eagerly gearing up to finally buy shares of Alibaba Group Holding Ltd. as the e-commerce giant gears up for a potential $20 billion boost in the coming year. This move comes after Alibaba’s plans for an upgrade to a primary listing in Hong Kong two years ago, amidst rising tensions with the US, are set to become a reality by the end of the month.

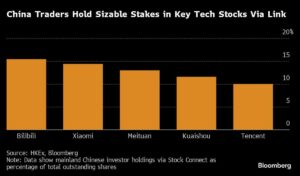

At Extreme Investor Network, we believe that this new source of funds via the “southbound link” could provide a significant uplift for Alibaba’s stock, which has been lagging behind its key rival Tencent Holdings Ltd. The addition of Alibaba to the Stock Connect program could attract mainland investors, with mainland holdings of the stock possibly reaching double-digit percentages, similar to other tech giants.

While Alibaba’s shares have only seen a modest 2% increase this year in Hong Kong, compared to the 25% rise of Tencent and Meituan, there are several factors at play. Weak retail sales in China have impacted Alibaba’s core business, while price wars in cloud services have put pressure on potential growth drivers. Additionally, regulatory crackdowns from Beijing and geopolitical tensions with Washington have also weighed on Alibaba’s shares in recent years.

Despite these challenges, there is optimism surrounding the potential upgrade to a primary listing in Hong Kong. If approved by shareholders at the upcoming annual general meeting, Alibaba’s shares could join Stock Connect as early as September 9, according to Morgan Stanley. Analysts predict inflows of around $12 billion to $19.5 billion, which could provide a much-needed boost to Alibaba’s stock performance.

Historically, the share price performance of other companies joining Stock Connect has been mixed. Our experts at Extreme Investor Network believe that Alibaba could potentially follow the trading pattern of Meituan, which outperformed the benchmark in the month after inclusion. Chinese investors gaining access to Alibaba’s shares could add momentum, especially in light of recent outflows of foreign funds.

Ultimately, the success of Alibaba’s stock may depend on its fundamentals and the market environment. However, the opportunity for Chinese investors to buy shares could amplify buying activity in the event of positive news. At Extreme Investor Network, we are excited about the potential for Alibaba’s upcoming Hong Kong listing to be a game-changer for investors and provide a much-needed boost to the e-commerce giant’s stock performance.

Stay informed with the latest updates on Alibaba’s listing and other top tech stories by visiting Extreme Investor Network. Subscribe to our newsletter to receive expert insights and analysis on the latest developments in the finance world.

Source: (Bloomberg) ©2024 Bloomberg L.P.