Why the Sept. 15, 2025, Third-Quarter Estimated Tax Deadline Matters: Key Timing Insights for Strategic Financial Planning and Investor Decision-Making

Navigating 2025’s Tax Landscape: What Investors and Advisors Must Know Now

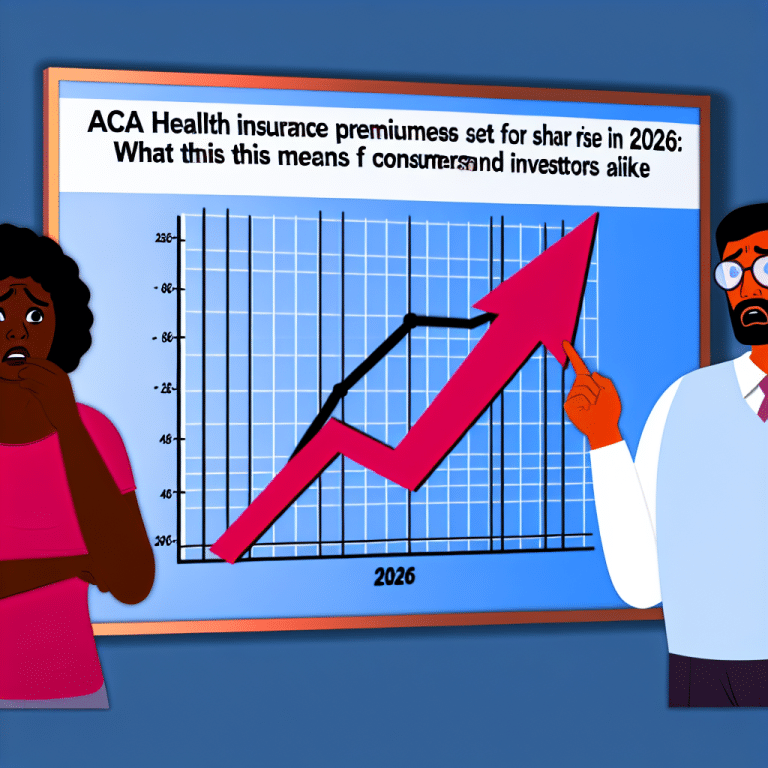

As the tax season of 2025 approaches, a critical yet often overlooked challenge is emerging for millions of Americans—especially those with complex income streams or living abroad. The tax reforms embedded in the recent “big beautiful bill” signed into law have introduced new tax breaks and altered withholding rules that could lead taxpayers to overpay if they don’t adjust their quarterly estimated tax payments accordingly. This isn’t just a minor inconvenience; it’s a financial pitfall that savvy investors and advisors must proactively manage to avoid unnecessary cash flow issues and penalties.

Why 2025 Estimated Taxes Will Be Trickier

Unlike the straightforward calendar quarters many expect, the IRS quarterly estimated tax deadlines for 2025 are staggered in an unusual pattern:

- Q1 (Jan 1 – Mar 31): Due April 15

- Q2 (Apr 1 – May 31): Due June 16

- Q3 (Jun 1 – Aug 31): Due Sept 15

- Q4 (Sept 1 – Dec 31): Due Jan 15, 2026

This misalignment can easily trip up taxpayers, especially those who rely on automated or habitual payment schedules. Certified Financial Planner Jim Guarino, CPA and managing director at Baker Newman Noyes, warns that without recalibrating withholding and estimated payments, taxpayers risk overpaying in Q3 and Q4, essentially giving the government an interest-free loan.

The Safe Harbor Rule: A Lifeline, But Not a Panacea

Many taxpayers lean on the IRS’s safe harbor provisions to avoid penalties. To stay penalty-free, you must pay either 90% of your 2025 tax liability or 100% of your 2024 tax liability—whichever is less. For high earners with adjusted gross income above $150,000, that bar rises to 110%. But here’s the catch: safe harbor compliance shields you from penalties, not from owing taxes. If you underpay, you could still face a sizable bill come tax time.

Melanie Lauridsen, VP of Tax Policy at the AICPA, emphasizes that estimated tax payments aren’t “one-size-fits-all.” Each taxpayer’s situation is unique, and the new tax breaks complicate projections further. This means relying on last year’s payments or rough estimates could lead to costly errors.

What Investors and Advisors Should Do Differently Now

-

Run Fresh Projections with Updated Tax Codes: The new tax breaks for 2025 affect withholding and estimated payments in nuanced ways. Advisors should work with clients to run updated tax projections that incorporate these changes. Don’t rely on 2024 returns as a baseline without adjustments.

-

Monitor Income Timing and Sources: For investors with variable income—such as freelancers, business owners, or those with capital gains—the timing of income recognition can impact estimated payments. For example, a client who realizes significant capital gains in Q3 may need to increase their estimated tax payments for that quarter to avoid penalties.

-

Leverage Technology and Professional Guidance: Tax software and financial planning tools are evolving to handle these complexities, but human expertise remains crucial. Certified professionals can interpret the interplay of new tax laws with individual circumstances better than automated systems alone.

-

Plan for Cash Flow Flexibility: Overpaying taxes reduces liquidity that could otherwise be invested or used for personal needs. Advisors should help clients balance paying enough to avoid penalties without unnecessarily tying up cash.

A Unique Insight: The Overseas Taxpayer Challenge

An often overlooked segment is the millions of Americans living abroad who must still file U.S. taxes. According to the IRS, approximately 9 million Americans reside overseas, many of whom face additional complexities with foreign income exclusions and credits. The 2025 tax changes may exacerbate these challenges, making quarterly estimated payments even more difficult to calculate accurately. Advisors working with expatriate clients should pay special attention to how these reforms interact with foreign earned income exclusions and tax treaties.

Looking Ahead: What’s Next?

Given the evolving tax landscape, we forecast increased demand for personalized tax planning services and a rise in technology solutions that integrate real-time tax law changes. Investors and advisors should anticipate a more dynamic tax management environment where proactive quarterly reviews become standard practice.

Actionable Takeaway

Start your 2025 tax planning now. Don’t wait for April 15 to realize your estimated payments were off. Engage a tax professional to run tailored projections, adjust withholding, and strategize income timing. For advisors, this is an opportunity to deepen client relationships by delivering proactive, customized tax strategies that protect wealth and optimize cash flow.

Sources:

- American Institute of Certified Public Accountants (AICPA)

- IRS Quarterly Estimated Tax Payment Guidelines

- Expert commentary from Jim Guarino, CPA and CFP

By staying ahead of these tax shifts, Extreme Investor Network readers can turn potential pitfalls into strategic advantages—because when it comes to taxes, timing and precision are everything.

Source: Third-quarter estimated tax deadline for 2025 is Sept. 15