Job Market Slowdown Unveiled: Key Factors and Strategic Moves Investors Must Know to Navigate Economic Shifts

The U.S. Job Market Hits a Chilling Pause: What Investors and Advisors Must Know Now

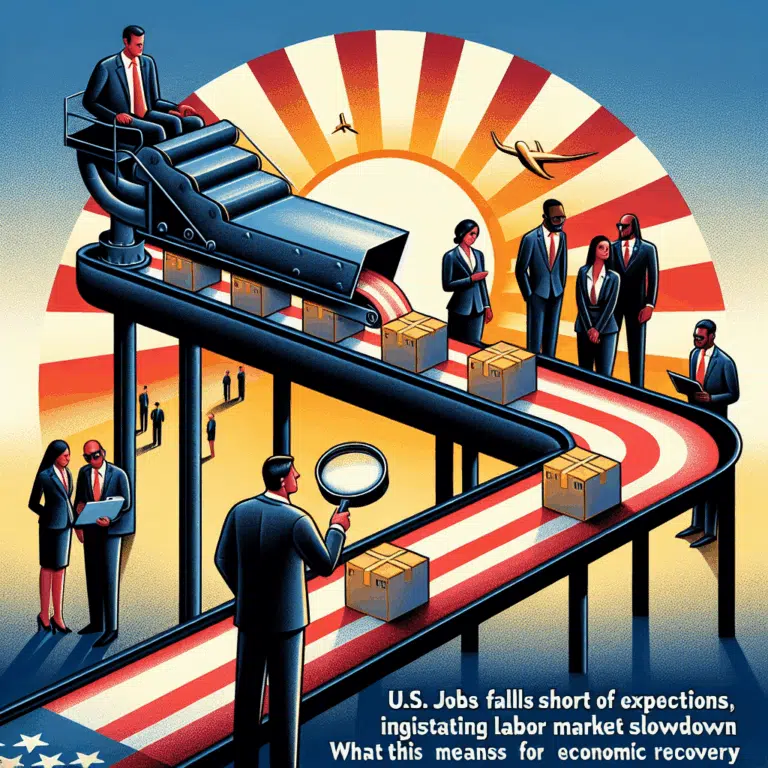

August’s employment report has sent a clear signal: the once red-hot U.S. labor market is cooling faster than many anticipated. With a mere 22,000 jobs added last month—well below expectations—and the unemployment rate climbing to 4.3%, the Bureau of Labor Statistics has punctuated a growing challenge for job seekers and a critical inflection point for investors and financial advisors alike.

Breaking a 53-month streak of uninterrupted job growth, the economy actually lost 13,000 jobs back in June, marking the first contraction since the pandemic’s early days. This shift is the most sluggish start to a year for job creation outside of the Great Recession era, according to Indeed’s Laura Ullrich. Capital Economics’ Bradley Saunders aptly describes the labor market as having “headed off a cliff-edge,” a metaphor that underscores the urgency of this development.

Why This Matters for Investors and Advisors

The labor market is a foundational pillar of economic health. When job growth stalls and unemployment edges higher, consumer spending—responsible for roughly 70% of U.S. GDP—tends to cool. For investors, this signals potential headwinds for sectors heavily reliant on discretionary spending, such as retail, hospitality, and consumer services.

Yet, it’s not all doom and gloom. Hiring remains “decent” in healthcare and hospitality, though looming cuts to federal Medicaid and social assistance funding could dampen future growth. This dynamic suggests a bifurcated labor market where some sectors may still offer opportunities, while others face contraction.

A recent report from the Federal Reserve Bank of Atlanta highlights that consumer confidence has dipped alongside labor market softness, reinforcing the idea that economic uncertainty is weighing on spending and investment decisions. For advisors, this means a strategic pivot may be necessary—shifting client portfolios toward sectors with resilient demand and away from those vulnerable to consumer pullback.

The Frozen Job Market: A Holding Pattern Amid Uncertainty

Employers are hiring at the slowest pace since 2013, yet layoffs remain historically low. This paradox points to a “holding pattern” where companies are cautious, waiting for clearer economic signals before making bold moves. Tariff policies and geopolitical tensions add layers of uncertainty, further complicating hiring decisions.

For investors, this signals a period of volatility ahead. Companies may struggle to grow earnings if labor market softness persists, yet abrupt layoffs could trigger short-term shocks. Monitoring labor market data closely will be crucial for timing entry and exit points in equities and other asset classes.

What Job Seekers—and Investors—Can Learn from This

From a workforce perspective, job seekers face a “musical chairs” scenario with far fewer seats than players. Career coach Mandi Woodruff-Santos advises maintaining sharp skills, especially in emerging software and technologies, and leveraging platforms like LinkedIn to build a personal brand. This proactive approach is essential in a competitive environment.

For investors and advisors, this translates into a broader lesson: adaptability is key. Just as job seekers must pivot and upskill, investment strategies should remain flexible and diversified. Consider increasing allocations to sectors demonstrating resilience, such as technology firms driving innovation in automation and AI, which may help companies weather labor shortages and cost pressures.

Actionable Insights: What’s Next?

- Diversify Sector Exposure: Healthcare and technology remain promising, but be cautious with consumer discretionary. Look for companies with strong balance sheets and pricing power.

- Monitor Labor Market Leading Indicators: Weekly jobless claims, job openings, and wage growth data can offer early signals of further shifts.

- Prepare for Volatility: Economic uncertainty may lead to market swings. Maintain a long-term view but be ready to rebalance portfolios in response to labor market trends.

- Emphasize Skills Development: For advisors, encourage clients to invest in their own human capital—continuous learning is a hedge against economic downturns.

- Explore Alternative Income Streams: Just as job seekers may take part-time roles or volunteer to stay relevant, investors should consider alternative assets or income-generating strategies to buffer against market volatility.

A Unique Perspective: The Rise of “Skill Arbitrage” in a Tight Market

One emerging trend worth watching is “skill arbitrage,” where companies seek talent globally to fill gaps created by domestic labor market freezes. Remote work has expanded this possibility, enabling firms to tap into international talent pools. Investors should track companies successfully leveraging this trend, as they may gain competitive advantages in cost management and innovation.

Final Thoughts

The labor market’s sudden chill is a wake-up call for all market participants. It’s a signal that economic growth may slow, consumer spending could tighten, and investment strategies must evolve. For job seekers, patience and adaptability are essential. For investors and advisors, vigilance and strategic recalibration will be the keys to navigating this new terrain.

By staying informed and agile, you can turn these challenges into opportunities—because in every market downturn lies the seed of future growth. Keep your eyes on the labor market’s next moves; they will shape the economic landscape—and your portfolio’s performance—in the months ahead.

Sources: Bureau of Labor Statistics, Glassdoor, Indeed, Capital Economics, Federal Reserve Bank of Atlanta

Source: Why the job market has weakened — and what to do about it