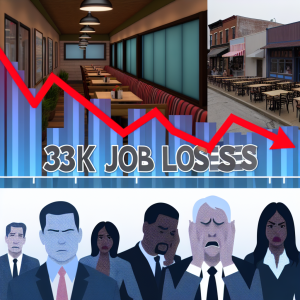

Midwest and West Job Losses Signal Regional Shifts, While Wage Growth Stalls: What Investors Must Know Now

The latest ADP employment report reveals a nuanced and regionally uneven labor market that deserves close attention from investors and financial advisors alike. The Midwest and Western U.S. experienced significant job declines—24,000 and 20,000 respectively—while the South bucked the trend by adding 13,000 jobs. This divergence is more than a footnote; it signals shifting economic dynamics that could reshape regional investment strategies and portfolio allocations.

Regional Weakness: A Deeper Dive

The Midwest and West’s job losses highlight persistent structural challenges. These regions, historically reliant on manufacturing, energy, and tech sectors, are facing headwinds from automation, energy transition pressures, and supply chain recalibrations. For example, in the Midwest, the automotive industry has seen layoffs tied to the shift toward electric vehicles and semiconductor shortages. Meanwhile, the West grapples with tech sector corrections and housing affordability crises that dampen labor demand.

Contrast this with the South, where job gains reflect ongoing corporate relocations, a booming logistics sector, and favorable business climates. States like Texas and Florida continue to attract companies seeking lower taxes and operational costs. Investors should consider increasing exposure to Southern regional ETFs or companies with strong Southern footprints as this trend unfolds.

Small Businesses Struggle as Larger Firms Expand

Another striking trend is the disproportionate impact on small businesses. Firms with fewer than 20 employees shed 29,000 jobs, while those with over 500 employees added 30,000. This bifurcation suggests that smaller enterprises still face cash flow constraints and labor shortages, despite overall economic resilience. For advisors, this means caution when recommending small-cap or local business investments, which may remain vulnerable. Conversely, large-cap stocks with robust balance sheets and hiring capacity could offer safer havens.

Wage Growth Cooling: What It Means

Wage growth has slowed slightly—pay gains for job stayers eased to 4.4% from 4.5%, and for job changers dropped to 6.8% from 7%. While modest, this deceleration signals easing inflationary pressures from the labor cost side, which the Federal Reserve will monitor closely. Slower wage growth can temper consumer spending, a key economic driver, but it also reduces the Fed’s urgency to hike rates aggressively.

Federal Reserve’s Next Moves: A Tightrope Walk

The ADP report precedes Thursday’s official nonfarm payroll data, where economists forecast a 110,000 job gain. Given ADP’s recent miss, downward revisions to expectations are likely. Traders have responded by pricing in a roughly 23% chance of a rate cut at the July Fed meeting, signaling growing market anticipation of easing monetary policy amid signs of labor market cooling.

From an investment perspective, this evolving Fed outlook suggests a pivot point. Advisors should prepare clients for potential volatility around the labor report and Fed communications. Defensive sectors like utilities and consumer staples may outperform if economic softness deepens, while growth stocks could benefit if rate cuts materialize.

Market Reaction: Cautious but Steady

Despite the labor miss, stock futures showed only minor dips—S&P 500 futures down 0.1%, Nasdaq 100 down 0.2%—reflecting a market caught between concerns over labor softness and hopes for Fed support. Treasury yields remain elevated (10-year at 4.285%, 2-year at 3.766%), underscoring cautious investor sentiment.

What’s Next for Investors?

-

Regional Allocation Reassessment: Investors should revisit geographic exposure, favoring Southern states and sectors poised to benefit from regional growth trends.

-

Focus on Large-Cap Stability: Given small business struggles, large-cap companies with strong hiring and cash flow profiles are likely safer bets in the near term.

-

Monitor Wage Trends: Wage growth will be a critical indicator of inflation trajectory and consumer spending health—key inputs for Fed policy and market direction.

- Prepare for Fed Volatility: The upcoming nonfarm payroll report could trigger market swings. Advisors should counsel clients on volatility strategies, such as diversifying into defensive sectors or hedging interest rate risks.

Unique Insight: The Remote Work Factor

An emerging factor not fully captured in this report is the ongoing impact of remote work on regional labor markets. According to a recent Pew Research study, about 59% of U.S. workers who say their jobs can be done remotely are working from home all or most of the time. This flexibility is reshaping talent distribution and could further accelerate job growth in tech-savvy Southern metros while exacerbating declines in regions less equipped for remote work infrastructure.

In Summary

The labor market’s regional disparities and slowing wage growth paint a complex picture that demands nuanced investment approaches. The Federal Reserve’s next moves hinge on these data points, making it imperative for investors to stay agile. Extreme Investor Network will continue to provide the sharpest insights and actionable strategies to help you navigate these shifting tides.

Sources:

- ADP National Employment Report, July 2024

- Federal Reserve Economic Data (FRED)

- Pew Research Center, Remote Work Trends, 2024

- Bloomberg Market Data

Stay tuned for our in-depth analysis post-Thursday’s nonfarm payroll release, where we’ll break down the implications and recommend precise portfolio adjustments.

Source: ADP Reports 33K Job Loss in June, Traders Eye Fed Moves as Services Lead Cuts