The Impact of Clinical Trial Design on Biotech Success

In an era where the biotech sector faces significant financial challenges, many companies are reconsidering their clinical trial strategies. Recent discussions, such as those at Swiss Biotech Day 2025, have highlighted the critical mistakes that can jeopardize a company’s future in this volatile environment.

The Dangers of Cutting Corners

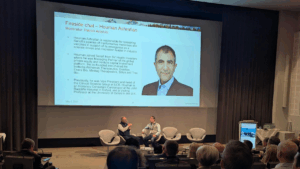

Houman Ashrafian, the executive vice president and head of Research and Development at Sanofi, emphasized the potential consequences of “squeezing” clinical trials to stretch limited resources. While the instinct to reduce costs may seem pragmatic, it can inadvertently accelerate a company’s downfall. Ashrafian warned, “Doing the wrong trial with your asset will kill it very quickly.” This reflects a broader truth: failing to adequately fund a trial can lead to disastrous results. For instance, investing an additional $3–$4 million could mean the difference between success and failure.

One pertinent example Ashrafian shared involved companies that announced trial outcomes near a p-value of 0.07—a threshold that substantially affected their share prices. He speculated that with a modest extension of the trial timeline and a slightly larger patient cohort, the results could have turned out differently, enhancing the companies’ valuation and market perception.

The Silver Lining of Financial Constraints

Despite the hardships, Ashrafian finds a silver lining in the shift towards more prudent financial management since the biotech boom of 2021. Many companies made reckless financial decisions, exposing themselves to considerable risks that were unsustainable in a scrutinized market. Ashrafian noted these preclinical companies often raised significant funding but lacked the operational maturity necessary to handle the industry’s rigorous demands.

“Biotech produced molecules at a significant discount to pharma,” he explained. “But the trial that determines the exit financing round is often not done as well.” This disconnect highlights the necessity for biotechs to refine their trial designs to secure funding for later-stage developments.

Leveraging Venture Capital for Success

To navigate these challenges, Ashrafian urged biotech firms to explore partnerships with venture capital arms, such as Sanofi’s, that specialize in funding clinical trials. These partnerships can provide the financial backing necessary to execute trials with precision and efficacy, ultimately setting the groundwork for pharmaceutical companies to step in for final development stages.

The transition from research to viable market product is fraught with hurdles. Biotech companies often excel in early-stage developments but struggle with the more complex aspects of trial management. Aligning with experienced partners who understand both the financial and scientific components of trial execution can significantly enhance prospects for success.

Conclusion: The Path Forward

The biotech landscape is changing, with financial prudence becoming more essential than ever. Companies must focus on robust clinical trial designs rather than merely looking to cut costs. As the sector evolves, those that adapt—by securing wise funding, extending trial periods, and embracing expert collaborations—will not only survive but thrive.

At Extreme Investor Network, we monitor these developments closely, ensuring that our readers are equipped with insights that drive informed investment decisions in the ever-evolving biotech sector.