The Gold Audit Conundrum: Where Does America’s Gold Really Stand?

In recent months, the speculation surrounding the United States’ gold reserves has intensified, particularly prompted by the high-profile call from Elon Musk to audit Fort Knox. This renewed scrutiny is compounded by actions from foreign governments, particularly Germany, which is considering pulling its gold reserves stored at the New York Federal Reserve due to transparency concerns. The burning question remains: Where is the gold?

The Forgotten Audits

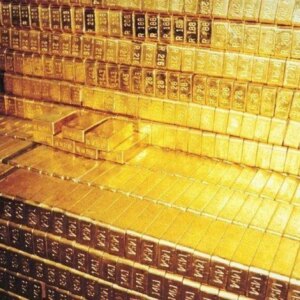

To dive deeper, let’s take a critical look at the history of gold audits in the U.S. The last comprehensive audit of America’s gold reserves was conducted back in 1953 under the Eisenhower administration. While officials claimed it was a “full” inspection, only 3 of the 22 compartments at Fort Knox were scrutinized, representing a meager 13.6% of the total holdings. Although approximately 88,000 gold bars were counted, the audit relied on limited sampling; only 26 bars were tested for purity and no third-party audits were allowed.

This lack of transparency raises eyebrows not just at home, but also internationally. During the Cold War era, when the audit took place, public confidence in the U.S. government was dwindling amid various covert operations, such as the CIA’s involvement in overthrowing foreign governments. Under such scrutiny, how could anyone trust that the nation’s gold is accounted for?

Evolving Standards: A Critical Eye on Future Audits

The situation hardly improved in subsequent audits. In 1974, the Government Accountability Office (GAO) conducted an inspection that, much like the 1953 audit, was criticized as little more than a PR stunt—only 21% of the gold was reviewed and third-party auditors were again absent. Over the years, as politicians and the public demanded transparency, the U.S. Treasury has conducted limited audits mainly focused on random samplings and surface inspections, but never allowed full access to independent parties.

Fast-forward to 2012-2013: politicians like Ron Paul and foreign governments continued to call for greater transparency with gold reserves. Another limited audit was conducted at the New York Fed, yet again, it was not a complete inventory. Of 34,201 gold bars, only a mere 367 bars were tested for purity.

The Transparency Gap

Transparency is key to public trust in monetary policies, especially for a reserve currency like the U.S. dollar, which depends heavily on the perceived value of gold reserves. While countries like the UAE and Switzerland conduct their own audits, they tend to examine only a small fraction of their holdings. The UAE must conduct yearly audits, but they only inspect 10-20% of their reserves under classified conditions. Switzerland, while more transparent, also primarily checks seals without conducting a thorough physical assessment of gold stocks.

The reality is that no nation fully audits its gold reserves, which exposes a shared vulnerability in the global financial landscape. As a result, the question of whether America’s gold reserves are intact or abandoned is less about actually missing assets and more about trust.

The Current Landscape: A Call to Action

Now, as the debate heats up, a variety of opinions arises regarding the future of America’s gold. Will governments around the world begin to demand complete transparency? Or will the elusive nature of gold reserves continue to foster skepticism? The U.S. Treasury recently stated that any extensive audit would be a breach of national security, further stoking concerns among the broader public and international observers alike.

At the Extreme Investor Network, we believe that transparency in financial systems is not just preferable—it’s necessary. If American gold reserves have remained intact, the public deserves to understand that through independent audits conducted under stringent standards, akin to what is seen in other nations.

Ultimately, the crux lies in establishing a trustworthy framework that guarantees the integrity of our reserves, thereby fortifying public confidence in the U.S. economic system at large. As investors, citizens, and economists, we must advocate for reforms that illuminate the truth behind the gold holdings that supposedly sustain not just our economy, but also our credibility on the world stage.

In an era where information is critical and transparency is paramount, it’s time for a national conversation about our gold reserves, ensuring they are not just a relic of the past, but a valid and well-audited assurance for our future.

Stay tuned to the Extreme Investor Network for more insights into the world of gold, investing strategies, and economic trends that matter to your financial well-being!