The Copper Conundrum: Analyzing the Future of Markets with Extreme Investor Network

As we navigate the labyrinth of global economics and volatile markets, one metal consistently captivates the attention of investors—the humble yet critical commodity: copper. Recently, our community at Extreme Investor Network has been engaged in a deep analysis of copper’s trends and the factors influencing its pricing. While mainstream sources often scratch the surface, we’re here to delve a little deeper and offer insights you won’t find anywhere else.

Understanding Market Dynamics

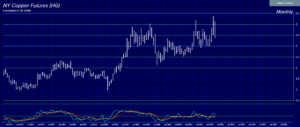

In the world of trading, especially in copper—a metal widely used in construction, electronics, and manufacturing—understanding the interplay of supply and demand is critical. As many speculators place blame on political factors like tariffs and trade disputes for fluctuating markets, we take a more nuanced view. Our analysis suggests that even before these events unfolded, an economic decline was on the horizon, projected to bottom out around 2028.

The recent forecasts highlighted a potential dip in copper prices driven by several factors including:

-

Reduced Demand from Key Economies: Particularly China, which has been on the falter lately. With its economy facing headwinds, copper demand has dwindled, following the broader slowdown in industrial activities.

-

Overproduction and High Inventory Levels: The expansions in mining operations worldwide (notably in regions like Chile and Peru) have led to a significant oversupply of copper. This overproduction has drastically outpaced demand, resulting in elevated levels of stockpiles on major exchanges like the London Metal Exchange (LME) and Shanghai Futures Exchange.

- Currency Influences: The greenback’s strength has complicated matters. A stronger U.S. dollar raises prices for foreign buyers, leading to decreased demand. Furthermore, this currency strength has not only impacted copper prices but has also incentivized foreign producers.

As we know from the dynamic framework of our insights, the copper market is intricately linked to various factors: macroeconomic conditions, emerging technologies that may reduce reliance on copper, and shifts in investor behavior.

Patterns Amid the Chaos

At Extreme Investor Network, we strive to identify hidden orders within the chaos of market fluctuations. Drawing upon our advanced predictive analytics, we recognize that economic forecasts often reveal patterns that might appear chaotic at first glance. For instance, a recent projection indicated a directional change and panic cycle anticipated for April 2025—a timeline informed by historical data and global economic trends.

When we harness the knowledge from our past projections—like those made back in 1999 predicting economic upheavals or the panic in 2008—it becomes clear how powerful understanding cycles can be. Think of it as the ebb and flow of the tides, representing not merely a series of unfortunate events but rather a pattern indicative of deeper trends.

The Road Ahead

Even as we head into uncertain waters, here at Extreme Investor Network, we’re committed to exploring the interconnectivity of the global economy. As suggested by historical figures like Margaret Thatcher, recognizing cycles can empower governments and investors alike to make more informed decisions.

We’re here to ensure you’re equipped with the insights and tools necessary to navigate these turbulent times. It’s crucial for our community of investors to stay informed and prepared for the shifts ahead.

Conclusion

As we uncover more about the state of copper and the broader market, we encourage you to join us at Extreme Investor Network. Our approach combines predictive analysis with historical context, offering you a unique lens through which to view navigating investments while making sense of today’s economic landscape.

Stay tuned for more updates—and watch for our upcoming feature film that delves deeper into these very topics, showcasing not just data but the people and stories behind these powerful predictions.

Get Involved!

Are you ready to redefine the way you approach investing? Join the Extreme Investor Network community today and gain access to exclusive insights, tools, and updates that empower you to navigate the complexities of the market.

Disclaimer: The predictions and insights provided are for informational purposes only and do not constitute financial advice. Always conduct your own research before making any investment decisions.