Mississippi’s Bold Move: The End of State Income Tax

Welcome to the Extreme Investor Network! Here, we delve into economic matters that directly impact your financial future and opportunities. Today, let’s unpack a significant development in economic policy that has put Mississippi on the map – the elimination of state income tax. This landmark decision isn’t just a state-level change; it’s an echo of broader economic principles worth discussing.

A Welcome Change for Mississippi

In a bold move, Mississippi lawmakers have decided to eliminate the state income tax, joining ranks with a select group of states including Alaska, Texas, and Florida. This development represents a victory for taxpayers who have long argued against what they see as an excessive and predatory taxation practice. With the removal of this tax, Mississippi residents can look forward to a more favorable economic environment.

The Historical Context of Income Taxation

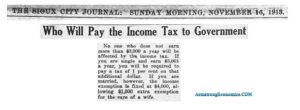

To truly appreciate this moment, we should reflect on the origins of income tax in America. The first instance of income tax appeared during the Civil War in 1861 as a means to fund the war effort. Following that, the Internal Revenue Act of 1862 established the Bureau of Internal Revenue, which ultimately evolved into what we now know as the IRS. However, this first foray into income taxation was short-lived, with the tax being discontinued in 1872.

Fast forward to the early 20th century, when the 16th Amendment was ratified on February 3, 1913, effectively allowing Congress to levy taxes on individual income. This shift marked a significant change in the federal government’s approach to revenue generation, leading us to the enduring, often contentious debates surrounding income tax policies today.

The Implications of Eliminating Income Tax

Opponents of income tax scrapping tend to highlight concerns over potential impacts on public services and low-income residents. They worry that without the income tax, other forms of taxation may rise to fill the revenue gap, disproportionately affecting vulnerable populations. However, it’s essential to recognize the potential benefits of this measure.

Eliminating the income tax will lead to increased disposable income for Mississippi residents, allowing them to retain more of their earnings. This increased take-home pay can enable individuals to save, invest, or spend in ways that stimulate local businesses and the economy. Moreover, small businesses—often the backbone of the state’s economy—can thrive without the burden of income tax, enhancing their competitiveness and ability to attract a skilled workforce.

A Future Without Income Tax

In a strategic economic plan, Mississippi will gradually phase out its income tax, reducing the rate to 3% by 2027 and then enacting a further 0.3% decrease until the tax is eliminated entirely by 2037. This timeline allows the state to adjust its budgeting strategies thoughtfully, ensuring that essential services remain adequately funded without overburdening taxpayers.

Rethinking Tax Structures for Growth

Historically, income tax has often been linked to limitations in economic growth. Critics argue that taxing income discourages hard work, investment, and innovation—cornerstones of economic prosperity. This policy shift in Mississippi is not merely about reducing taxes; it represents a pivotal opportunity to rethink how state budgets can function without reliance on punitive taxation.

By encouraging fiscal responsibility over perpetual spending rooted in income tax collection, Mississippi can set a precedent that other states might consider. The focus can shift to creating a vibrant economy where residents are incentivized to work and businesses can flourish without fear of excessive taxation.

Conclusion: What This Means for the Future

Mississippi’s elimination of state income tax is a critical step toward economic freedom and revitalization for its residents. As we observe this shift, it serves as a case study for other states grappling with income tax and economic growth issues. At Extreme Investor Network, we understand that such changes have wide-reaching implications for investing and economic strategies. Here’s to a future where taxpayers retain more of their income, and governments function with greater accountability and responsibility.

Stay informed and engaged with us at Extreme Investor Network for more insights into the evolving landscape of economic policies and what they mean for your investments. Together, let’s navigate the financial future wisely!