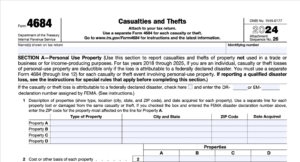

Understanding Form 4684: Your Guide to Claiming Casualty and Theft Loss Deductions

Form 4684, titled "Casualties and Thefts," is a critical tool for individuals, businesses, and estates who have experienced unexpected financial losses due to theft or disasters. It allows taxpayers to claim deductions that can significantly reduce their taxable income. However, understanding the eligibility requirements and the calculation process can be complex. At Extreme Investor Network, we aim to simplify this for you.

What Kind of Losses Are Covered?

The IRS categorizes losses as either casualty losses or theft losses:

-

Casualty Losses: These result from sudden, unexpected events like natural disasters, accidents, or fires. Common examples include damage caused by hurricanes, earthquakes, or floods.

- Theft Losses: These are the result of criminal acts such as burglary or fraud, where property has been taken without the owner’s consent.

It’s important to note that only losses from federally declared disasters and qualified thefts are eligible for deductions under Form 4684.

Eligibility Requirements

To successfully claim a deduction, you must meet several qualifications:

- The loss must arise from a federally declared disaster as designated by the Federal Emergency Management Agency (FEMA).

- The situation must be unexpected and beyond your control. This encompasses events like floods, tornadoes, and wildfires.

- The property affected must be personal-use or business property that hasn’t already been compensated by insurance or relief programs.

- Tax laws allow you to claim such losses in either the year the disaster occurred or in the preceding year, potentially offering a more favorable tax situation.

Steps to Claim Your Deductions

Claiming deductions for casualty and theft losses involves several methodical steps to ensure that you maximize your benefits:

- Obtain Form 4684: Download it directly from the IRS website or through tax preparation software.

- Determine Cost Basis: Calculate the original value of the property before the loss occurred.

- Evaluate Fair Market Value (FMV): Assess the property’s FMV before and after the event to gauge the true financial impact.

- Account for Reimbursement: Subtract any insurance payouts or other compensations received for the loss.

- Apply Deductions: Reduce the loss amount by $100 for each event and then deduct 10% of your adjusted gross income (AGI).

- Report on Schedule A: If you’re claiming a personal deduction, transfer the calculated loss to your Schedule A (Itemized Deductions).

- Attach Form 4684 to Your Tax Return: Finally, attach Form 4684 to your Form 1040 and file your return.

Examples and Non-Qualified Losses

Understanding what qualifies as a disaster loss can clarify the process:

Qualified Disaster Losses:

- A home destroyed by a wildfire in a federally declared area.

- A vehicle damaged due to flooding in a designated flood zone.

- A business property structurally damaged by a hurricane.

Non-Qualified Losses:

- Damage from gradual deterioration (like termite damage).

- Losses due to personal negligence, such as an unlocked vehicle being stolen.

- Property damage not associated with a federally declared disaster.

Additional Considerations

While the filing process might seem straightforward, IRS regulations can be intricate. Non-qualified and certain personal-use property losses generally do not allow for a carryforward option beyond the year of occurrence. In contrast, investment or business losses may qualify for different tax provisions.

When dealing with theft losses, you must provide proof of the event, including police reports and changes to fair market value. Remember, if your insurance payout exceeds your property’s original value, that excess must be reported as taxable income, converting it into a potential capital gain.

Why Work with a Financial Advisor?

Navigating the complexities of tax rules can be daunting, but fortunately, you don’t have to go it alone. A financial advisor can help you understand the nuances of deductions related to casualty and theft losses, ensuring you claim everything you’re entitled to. They can also assist in strategizing to maximize your potential tax relief, potentially revealing opportunities for savings that you might have overlooked.

At Extreme Investor Network, we connect you with experienced advisors who can guide you through the filing process, helping you achieve your financial goals while optimizing your tax outcomes. Take the first step and explore how our network can support you.

Conclusion

Filing Form 4684 can be your pathway towards recovering from unexpected financial setbacks related to theft or disasters. With careful preparation, understanding the requirements, and possibly enlisting the assistance of a qualified financial advisor, you can ensure that you not only comply with tax regulations but also maximize your potential deductions. For more tailored advice and insights into your financial journey, consider exploring our resources at Extreme Investor Network. We’re here to help you make the most of your investments and navigate the financial landscape effectively.