Nvidia’s GPU Technology Conference: Insights and Opportunities for Investors

Welcome to the Extreme Investor Network! Today, we delve into one of the most eagerly awaited events in the tech calendar—the GPU Technology Conference (GTC) by Nvidia. As investors, understanding the nuances shared during this conference can provide vital insights into potential investment opportunities and market trends. Let’s explore the key takeaways from GTC and what they mean for Nvidia’s future.

Nvidia’s Position and Recent Performance

Nvidia, the titan of graphics processing units (GPUs) and a cornerstone in the world of artificial intelligence (AI), has recently encountered a slip in its stock performance. After witnessing remarkable gains over the past two years, shares have decreased by 15% in just one month and sit 22% below their all-time high reached in January. This decline has undoubtedly raised eyebrows among investors as the company navigates a pivotal moment.

Demand for Next-Gen Blackwell Chips

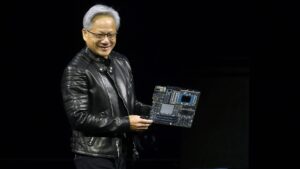

During the conference, CEO Jensen Huang addressed a hot topic among analysts: the demand for Nvidia’s Blackwell chips. Huang revealed an estimated 3.6 million shipments to the four largest cloud service providers in 2023, a figure he believes may have been underplayed. He emphasized the exponential growth in computational needs due to AI, indicating that these top clients remain “fully invested.”

Morgan Stanley analyst Joseph Moore noted this disclosure was groundbreaking, as it showcased Nvidia’s confidence in their current demand landscape. Analysts expressed optimism that not only the leading customers are looking to Nvidia for their computing needs, but that interest extends to a broader market hungry for cutting-edge AI capabilities. Moreover, Piper Sandler analyst Harsh Kumar suggested that demand is likely burgeoning beyond the core customers, indicating a saturated market ready to commoditize Nvidia’s products.

The Rise of Physical AI

An exciting development highlighted during GTC was the shift towards “Physical AI”—the practical application of AI technologies in real-world scenarios rather than just software. This is an area that previously seemed speculative but is now materializing with substantial potential. Truist analyst William Stein articulated this opportunity, estimating a $50 trillion market for Nvidia as it delves deeper into robotics and automation.

Huang demonstrated the capabilities of the Isaac GR00T N1—an advanced, customizable model designed for humanoid robots. This innovation could position Nvidia at the forefront of the burgeoning robotics sector and presents significant avenues for growth.

Navigating Tariffs and Macroeconomic Pressures

With macroeconomic uncertainties looming, including rising tariffs, Huang addressed potential impacts on Nvidia’s operations. He reassured investors that the company has been proactively adapting by localizing manufacturing, specifically utilizing Taiwan Semiconductor’s Arizona fab for production. This strategic move aims to mitigate the risks posed by international trade tariffs.

Bernstein analyst Stacy Rasgon found Huang’s insights reassuring, as his emphasis on domestic manufacturing could soothe fears of a recession affecting Nvidia’s customer spending. Huang argued that companies often prioritize cutting expenditures that don’t contribute to growth, suggesting that the core IT spending driving demand for Nvidia’s products remains intact.

Why This Matters to Investors

Nvidia’s developments shared during GTC present both challenges and remarkable opportunities. With the company actively reshaping its narrative to refocus on strong demand profiles and breakthroughs in physical AI, investors have the chance to align their portfolios with future growth sectors likely to outperform in the coming years.

The landscape in tech can change rapidly; thus, staying ahead of the curve is crucial for investment success. At Extreme Investor Network, we pride ourselves on providing you with crucial insights and timely analysis to navigate these developing trends, helping you make informed investment decisions that align with your financial goals.

Conclusion: As Nvidia continues to solidify its position as a leader in AI and GPUs, watching the market responses and exploring emerging opportunities related to their innovations will be integral for keen investors. Keep following us for more insights and analysis on how these developments play out in the long term.