Asian Markets Experience Optimism Amidst Geopolitical Tensions

In a noteworthy turn of events, Asian stock markets recorded their third consecutive day of gains, largely driven by significant upticks in both the Japanese and Hong Kong markets. This rally comes amid a broader shift in investment strategies, as global investors increasingly explore opportunities outside of the U.S., influenced by the uncertainties linked to geopolitical developments, particularly those involving former President Donald Trump.

Major Market Movements

Hong Kong equity benchmarks surged by approximately 2%, largely powered by the remarkable performance of BYD Co., which reached a record high following the launch of its innovative charging system for electric vehicles. Meanwhile, Japanese markets saw gains of over 1%, spurred by Berkshire Hathaway Inc.’s expanded investments in Japan’s leading trading firms, further confirming a promising outlook for long-term economic growth.

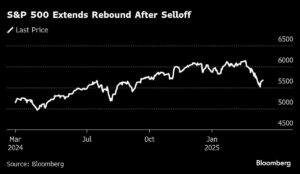

As the S&P 500 Index in the U.S. closed positively at 0.6%, the sentiment seems to have shifted from the traditionally dominant U.S. equities to favoring Asian markets. This is particularly relevant as U.S. equity futures showed a slight retreat, signaling cautious investor sentiment ahead.

Shifts in Investment Focus

The impetus behind this shift can be traced back to recent corrections in U.S. stock prices, compounded by a renewed focus from China on enhancing domestic consumption — a move seen as a strategy to reduce dependence on global trade, including tariffs. Changes in rhetoric from Beijing are proving to be market-friendly, playing a crucial role in bolstering the Asian equity markets. Senior macro strategist Homin Lee at Lombard Odier highlights that the influx of investments from notable figures like Warren Buffett is positively shaping market sentiment.

Gold and Commodities Surge

In the commodities market, gold has seen an impressive surge, reaching a historic high of over $3,000 per ounce. Concurrently, oil prices have risen for three consecutive days, driven by escalating tensions in the Middle East, igniting fears of a potential global supply crunch.

Japanese Economic Indicators

Looking to Japan, the financial sector is on the rise as yields climb in anticipation of the Bank of Japan’s imminent policy decision. Economists expect the central bank to maintain its policy rate at 0.5%. However, with the yen nearing the critical 150 mark against the dollar, the market remains uncertain about future currency movements.

Key Economic Indicators This Week

Investors will be keeping a close eye on major economic announcements scheduled for the week:

- U.S. Data Releases: Retail sales, housing starts, and industrial production figures are set for Tuesday.

- Central Bank Decisions: The Bank of Japan and the Federal Reserve are poised to announce their respective rate decisions on Wednesday. Insights from these meetings will be pivotal in shaping market expectations.

- China & U.K. Developments: Further developments in China’s loan prime rates and the Bank of England’s rate decision on Thursday will also be crucial, as will the U.S. Philadelphia Fed factory index and jobless claims later that day.

A Broader Global Perspective

As market dynamics continue to transform, it’s essential to stay informed about how these shifts impact both strategic investment choices and broader economic trends. Key events, including the forthcoming U.S. Federal Reserve meeting, will be instrumental in determining not just the future trajectory of the markets but the potential resilience of economies in the face of continued geopolitical uncertainty.

In summary, the rising optimism in Asian markets—and particularly Japan and Hong Kong—highlights a shifting landscape for global investors, one that may prove advantageous for those who are agile and informed as we navigate the complexities ahead.

Stay tuned at Extreme Investor Network for continuous updates and valuable insights to help you thrive in these evolving markets.