—

## Navigating Financial Waters: Insights from Treasury Secretary Scott Bessent on Sustainable Economic Practices

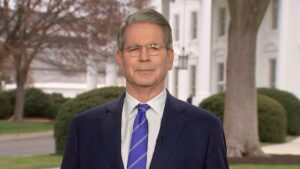

At Extreme Investor Network, we understand that the financial landscape can change rapidly, and keeping informed about the latest developments is crucial for both seasoned investors and newcomers alike. Recently, Treasury Secretary Scott Bessent provided insights during an interview with CNBC that shed light on the government’s fiscal policy and the potential implications for the economy and markets.

### Tackling the Looming Financial Crisis

In his recent discussion, Secretary Bessent emphasized the Trump administration’s commitment to averting a financial crisis that might stem from excessive government spending in previous years. He stated, “What I could guarantee is we would have had a financial crisis. I’ve studied it, I’ve taught it, and if we had kept up at these spending levels, everything was unsustainable.” This candid acknowledgment serves as a reminder that sustainability in government financial practices is critical to maintaining economic stability.

At Extreme Investor Network, we believe understanding fiscal responsibility is essential for investors. With the government acknowledging previous overspending and taking corrective actions, investors can better navigate the evolving market landscape.

### A New Era of Efficiency

One significant step in this direction has been the establishment of the Department of Government Efficiency, headed by none other than tech visionary Elon Musk. This initiative aims to streamline governmental operations through job cuts and early retirement incentives, fostering a leaner bureaucracy. For investors, this represents an interesting intersection of technology and governance, signaling a potential increase in operational efficiencies that could bolster the economy.

### Rising Concerns Amidst Economic Growth

Despite these measures, challenges remain. In February, the U.S. budget shortfall tragically passed the $1 trillion mark, highlighting how rapidly the debt and deficit issues continue to escalate. Bessent reminded viewers that “there are no guarantees” against an impending recession. As enthusiastic as we may be about government initiatives, caution remains imperative.

### Market Volatility: A Healthy Reality

Current market conditions have been volatile, with Trump’s aggressive tariff policies raising concerns over inflation and economic slowdown. The S&P 500 recently entered a 10% correction phase, a situation that may cause anxiety among investors. Nevertheless, Bessent holds an optimistic perspective, asserting, “I’ve been in the investment business for 35 years, and I can tell you that corrections are healthy. They’re normal.”

At Extreme Investor Network, we echo that sentiment. Market corrections, while unsettling, often serve as a necessary adjustment mechanism to maintain long-term growth. It keeps exuberance in check and helps prevent the euphoric bubbles that can precipitate financial crises.

### Looking Ahead

Bessent is confident that, given a favorable tax policy, deregulation, and energy security measures, the markets will ultimately flourish. “One week does not the market make,” he emphasized, reminding us that investing should always be approached with a long-term view rather than a reactive mindset.

### Conclusion: Investing in Knowledge and Sustainability

As we conclude this exploration of Secretary Bessent’s insights, we at Extreme Investor Network encourage our readers to stay informed and diligently analyze both government actions and market signals. A well-rounded perspective allows for more sound investment decisions, especially in uncertain times. By balancing fiscal sustainability with proactive investment strategies, you can position yourself for success in the ever-evolving financial landscape.

Stay tuned to Extreme Investor Network for further updates and expert analyses aimed at empowering you in your investment journey!

—

By providing a context around the insights and enriching the content with detailed analysis, we aim to enhance reader engagement and position our blog as a valuable resource for investors navigating today’s financial markets.