Market Overview: Analyzing the Latest Trends and Predictions

As we enter a new week, the Asian stock markets are gearing up for a bumpy ride, influenced heavily by economic signals coming from the U.S. and China. Recent developments have created an environment filled with uncertainty, prompting investors to cautiously adjust their strategies.

Asian Markets Prepare for Volatility

Trading in Australian stocks remained relatively stable, while Japan’s equity-index futures showed some positive movement. In contrast, futures for Hong Kong indicated a downward trend. American futures, specifically for the S&P 500 and the tech-centric Nasdaq 100, experienced declines. The yen gained strength amidst these fluctuations as oil prices continued to slide, marking a seventh consecutive week of losses. Bitcoin investors are also facing challenges, as the cryptocurrency saw further declines.

In an era marked by high volatility, evidenced by the Cboe Volatility Index climbing above 26 last week, market participants should keep a close eye on potential movement in key indexes. This level of volatility hasn’t been seen since the tumultuous days of the COVID-19 pandemic.

Economic Insights from the Federal Reserve

Federal Reserve Chair Jerome Powell provided some insights on the U.S. economic landscape during a recent address. He acknowledged rising uncertainties regarding future economic conditions but emphasized that there’s no immediate need for a rush to cut interest rates. Powell also expressed optimism about progress towards the Fed’s target of 2% inflation, suggesting that the recent price increases from tariffs might be temporary in nature.

Adam Crisafulli, founder of Vital Knowledge, noted that Powell’s calm demeanor, coupled with his positive assessment of inflation trends, appeared to positively influence the market. Following his comments, Treasury yields witnessed an uptick, reversing some earlier losses, as the market adjusted expectations around the timing of potential interest rate changes.

Labor Market Developments

The latest U.S. job figures painted a mixed picture. While nonfarm payrolls increased by 151,000 in February, the unemployment rate ticked upward to 4.1%. Glen Smith, Chief Investment Officer at GDS Wealth Management, flagged concerns that this report did not account for significant government job cuts, indicating that businesses might be delaying hiring until there’s more certainty regarding tariff policies and the overall economic outlook.

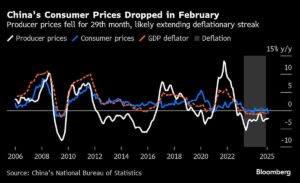

Asian Economic Indicators: China Focus

In Asia, the recent data highlighted a deeper-than-anticipated fall into deflation in China, with consumer inflation dropping below zero for the first time in 13 months. Investors are keen to observe whether the government’s economic stimulus measures will spur stronger domestic demand in the near future.

Additionally, China escalated trade tensions by announcing retaliatory tariffs on imports of rapeseed oil, pork, and seafood from Canada, intensifying the complex dynamics of global trade relationships.

Market Performance Recap

Despite a last-minute rebound on Friday, the S&P 500 concluded its worst week since September, marking a nearly 7% decline from its February peak. Technology stocks have been particularly hard hit, with the Nasdaq 100 nearing a technical correction.

In the commodities space, gold prices have shown resilience, increasing over the past week as investors sought safety amidst the uncertainty plaguing stock markets.

What’s Ahead: Key Economic Events to Watch

This week will be crucial, with several important economic indicators set to be released:

- Germany Industrial Production – Monday

- Japan Current Account – Monday

- Australia Consumer Confidence – Tuesday

- U.S. Job Openings – Tuesday

- Canada Rate Decision – Wednesday

- UK Industrial Production – Friday

Monitoring these releases will be essential for investors as they navigate the complexities of the global economic landscape.

Market Movements at a Glance

- Stocks: Futures for the S&P 500 dropped 1% early Monday, while Hang Seng futures decreased by 0.4%. Australia’s S&P/ASX 200 remained flat.

- Currencies: The Bloomberg Dollar Spot Index showed little change, while the euro climbed 0.2% against the dollar.

- Cryptocurrencies: Bitcoin traded down 3.6%, further exacerbating recent challenges for digital asset investors.

- Commodities: WTI crude dipped 0.6% to $66.61 per barrel; gold increased slightly to $2,913.63 per ounce.

As these insights wrap, it’s crucial for investors to remain vigilant and adaptable in these shifting economic conditions. Stay with us at Extreme Investor Network as we continue to provide timely updates and actionable insights on market trends.