AMD: Analyzing the Dip and Potential for Recovery

Advanced Micro Devices (NASDAQ: AMD) finds itself at a challenging crossroads. Over the past year, it has been hailed as one of the worst-performing stocks in the tech sector. While expectations for AMD soared as analysts anticipated its gaining ground against Nvidia in the lucrative data center market, the reality has been less promising. Instead of carving out market share, AMD has struggled, leading to a sharp decline in stock value.

Performance Metrics: A Year to Forget

Since reaching a peak in March, AMD’s stock price has plummeted over 50%, a stark contrast to Nvidia’s meteoric rise of more than 50% during the same timeframe. This significant disparity raises an important question: could this downturn actually signal a window of opportunity for investors looking for a potential turnaround?

AMD’s diversity in product offerings—spanning graphics processing units (GPUs), CPUs, and embedded processors—provides a robust brand portfolio. However, the competitor Nvidia has honed in on GPUs exclusively, dominating the data center space where AMD has continually lagged. Notably, during AMD’s fiscal fourth quarter, data center revenue grew by 69% year-over-year to $3.86 billion. While on the surface this figure appears strong, it pales in comparison to Nvidia’s staggering 93% revenue increase, which totaled $35.6 billion.

This underperformance in the data center segment has proven to be a critical factor contributing to AMD’s stock slide.

Segmented Performance Insights

AMD’s fiscal health shows discrepancies across various segments. The client revenue—driven by sales of CPUs and GPUs for consumer laptops and PCs—rose by 58% year-over-year. However, this growth comes with an asterisk: the broader market for personal computing is becoming increasingly commoditized, limiting growth potential as the performance leap between competitors narrows.

On the flip side, AMD’s gaming revenues saw a significant contraction, plunging by 59% year-over-year. The embedded processors segment also dipped by 13%. Despite overall revenue growth of 24%, the shortfall against Wall Street expectations creates an ongoing wave of skepticism regarding AMD’s stock prospects.

Valuation Considerations

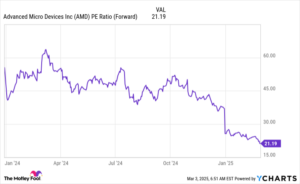

AMD’s valuation presents a critical perspective for potential investors. Despite facing a challenging year, it currently operates at a forward P/E ratio of 21.2, a valuation near the broader market average of 21.6. This makes AMD appear reasonably priced, especially when considering that analysts project revenue growth rates of 23% in 2025 and 21% in 2026. Such potential indicates AMD’s capability for faster-than-average growth, positioning it as a compelling candidate in the tech sector for investors looking for value.

Moreover, while AMD may not be positioned to dethrone Nvidia, it offers enough quality metrics to suggest a rebound could be on the horizon. As the company works to recalibrate its strategy, there remains an avenue for profits, making it an enticing stock pick for those willing to weather the current challenges.

Final Thoughts: To Buy or Not to Buy?

Before leaping into an investment with AMD, potential buyers should consider the overall market landscape carefully. Analyst recommendations can provide useful insights, and it’s worth noting that some credible sources—like the Motley Fool—have suggested alternative stocks that they believe carry a greater potential for returns.

In a climate where the performance of the tech sector can drastically shift, staying informed on market trends and valuations will position investors to capitalize on opportunities as they arise. While AMD has faced substantial hurdles, it may still present a viable investment option for those who believe in its underlying capabilities for recovery.

In retrospect, the immense past volatility of stocks like AMD underscores the importance of due diligence and strategic timing in investment decisions.