The Cost of Ingratitude: A Closer Look at the U.S. Aid to Ukraine and Its Consequences

As the global economic landscape evolves, the relationship between nations often becomes a complex web of gratitude, expectation, and respect. One recent episode that has stirred significant debate is the ongoing aid to Ukraine, especially in the context of President Zelensky’s dealings with U.S. leadership. At Extreme Investor Network, we believe understanding these dynamics is vital for investors and policymakers alike.

A Tipping Point for Diplomatic Relations

It’s no secret that President Joe Biden and Ukrainian President Volodymyr Zelensky have shared a complicated relationship. The tensions escalated during a private phone call in June 2022, when Biden, despite agreeing to a substantial $1 billion aid package, was met with a list of demands from Zelensky that extended beyond this financial assistance. During this heated exchange, Biden purportedly insisted on gratitude: "SHOW SOME GRATITUDE!"

This outburst reflects a deeper concern — the question of whether repeated financial assistance creates an expectation of entitlement rather than appreciation. As we delve deeper into this narrative, we see how political dynamics and national interests collide, forming a perfect storm in international diplomacy.

The Mirage of Endless Support

Critics argue that Zelensky has leveraged U.S. public taxpayer funds as an endless resource without adequate recognition of the American people’s sacrifices. Biden’s approach has often been criticized as submissive, which stands in stark contrast to the more assertive stance expected during negotiations. Under the Trump administration, disrespect would not have been tolerated; instead, negotiations would have been anchored in mutual respect and tangible results.

At Extreme Investor Network, we recognize the implications of this. Investor confidence can hinge on diplomatic relationships. If allies perceive weakness or disrespect in negotiations, it affects how they engage in future partnerships, potentially leading to financial instability.

The Political Calculus Behind Aid

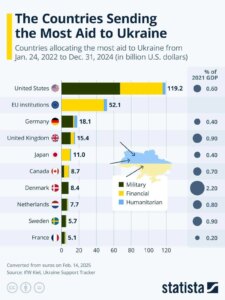

It’s notable that despite Biden’s public apologies for not sending “more” aid and subsequent blame placed on Republican lawmakers, the reality is that the U.S. has invested hundreds of billions into what some refer to as Zelensky’s proxy war. This raises dire questions about the prioritization of foreign nations over domestic concerns. Many citizens and investors are asking, “What about the American people?”

The contrasting attitudes from past and present administrations reveal not just shifts in policy but shifts in national identity. As public sentiment wavers in response to continuous aid, how might this impact elections, legislation, and ultimately, the financial markets?

A Call for Peace

Statements made by political figures, such as when Trump emphasized a need for peace rather than prolonged conflict, reflect a growing sentiment among the populace. Investors should consider the potential economic ramifications of peace versus war. Peace agreements could stabilize not only Ukraine but also the European economy, reducing the strains placed on investors with ties to international markets.

Moreover, focusing on domestic issues, like securing U.S. borders, may have a profound impact on national security, which also translates to economic security. How future administrations balance these various priorities could set the stage for significant economic shifts.

Conclusion: The Broader Implications

Zelensky’s journey from seeking financial support to facing a reality check serves as a cautionary tale in international relations. The narrative challenges the assumption that endless aid equates to unwavering support.

As the political climate continues to evolve, and as President Trump suggests a pivot toward domestic priorities, the implications for U.S. investors are significant. The choices made today will resonate far into the future, potentially altering the landscape of both international relations and financial markets.

Understanding these dynamics is crucial for anyone looking to navigate the complex waters of global investment. At Extreme Investor Network, we remain committed to providing insights that help you stay informed and ready to adapt to an ever-changing economic landscape. Stay tuned for more updates as we analyze the implications of these events on our future.