The State of the Solar Industry: Turbulence Ahead

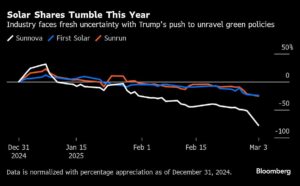

Sunnova Energy International Inc. recently saw its stock plummet by a staggering 71%, a move that echoed growing concerns within the solar industry about its future stability. This alarming decline came just days after major players like First Solar, the largest solar manufacturer in the U.S., reported rising customer delays, and Sunrun, the nation’s top residential solar provider, warned of stagnant installation volumes for the year.

The solar sector, once hailed as the future of renewable energy, is undergoing its most significant reckoning in over a decade. Factors such as soaring interest rates and diminishing state incentives are wreaking havoc on rooftop solar businesses. Adding to this turmoil, political maneuvers—particularly under former President Donald Trump’s administration—are complicating the landscape for large-scale solar developments. The uncertainty surrounding the future of policies such as the Inflation Reduction Act, originally enacted to boost green energy initiatives, is leaving investors on edge.

Current Challenges and Industry Woes

At the recent Intersolar & Energy Storage North America conference in San Diego, industry leaders voiced their deep concerns about the volatility of the market. Many attendees articulated that the uncertainty reverberating throughout the industry is expected to linger for much of the year, with many holding off on new investments due to unpredictable regulatory policies. "With uncertainty comes risk, and with risk comes a holding back of new investments," warned Tom Starrs, EDP Renewables’ vice president of government and public affairs.

This upheaval has striking implications, especially as the demand for electricity continues to rise—potentially exacerbated by the burgeoning artificial intelligence industry. Last year, solar energy contributed the largest share of new U.S. power capacity, and experts anticipated similar results for 2024. However, with Trump’s administration leaning toward natural gas as a primary energy source, the future of solar energy is bleak and raises questions about its longevity in the market.

Sunnova’s Challenge

Sunnova’s alarm bells are ringing louder than ever. The company disclosed a cash shortfall that jeopardizes its operations and has suspended its financial guidance. In an effort to stabilize its situation, Sunnova is exploring various strategies including refinancing debt and reducing expenses, along with hiring financial experts to navigate these fiscal waters. Despite these proactive measures, stock prices for Sunnova decreased to just 64 cents, marking one of the most significant declines in its trading history.

Meanwhile, Sunrun, too, has lowered its cash generation forecast for the year, sending ripples throughout the industry. Analysts are now slashing home solar installation projections for 2025, reflecting a nearly 20% drop in installations from the previous year. As political discussions around cutting tax credits continue, the landscape becomes more daunting for firms like Sunnova and Sunrun.

Brighter Days Ahead?

While the current atmosphere appears to be one of chaos and uncertainty, the solar sector is still positioned to address the growing energy demands effectively. According to First Solar CEO Mark Widmar, the U.S. will require an additional 128 gigawatts of new capacity by 2029 to meet peak summer demand. Yet, even if natural gas plants are brought online, predictions indicate an unmet power demand of approximately 114 gigawatts by 2030.

One benefit of solar energy is its ability to scale quickly compared to other energy sources such as natural gas and nuclear energy. Large-scale nuclear projects can take over a decade to become operational, while the lead time for new natural gas facilities can span several years, exacerbated by supply chain constraints and rising costs. This inherent nimbleness may give solar companies an edge in rapidly addressing energy needs, but challenges remain.

The sentiment at the conference hinted at a critical juncture for the solar industry. Many developers have reported increased latency in government responses, which adds roadblocks to project timelines. "This is rock bottom as it relates to uncertainty," said TD Cowen analyst Jeff Osborne, capturing the shared angst among industry leaders.

Conclusion

As the solar industry navigates these turbulent times, companies must adapt and innovate to pursue sustainable, long-term growth. While current forecasts and industry sentiment paint a challenging picture, opportunities exist for agile firms ready to rise to the occasion. The coming months will be crucial, and the decisions made today could shape the future of solar energy in America for years to come.