The SEC’s Crypto Makeover: A New Dawn for Digital Assets

As the year unfolds, the United States Securities and Exchange Commission (SEC) is giving the cryptocurrency landscape a much-needed facelift. The agency is making headlines by halting numerous enforcement actions against major crypto players, effectively transforming a once-hostile regulatory environment into a more inviting arena for digital assets.

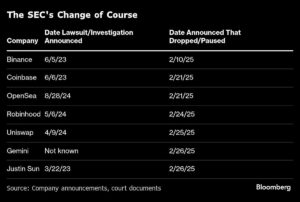

In just the last month, the SEC has either dismissed or paused at least eight high-profile cases involving prominent names in the crypto space, including exchanges like Coinbase and Binance, which faced lawsuits almost simultaneously last summer. Other companies, such as Robinhood, Uniswap Labs, and OpenSea, were also on the enforcement radar but are now seeing a shift in the narrative.

John Reed Stark, a former SEC enforcement attorney, describes this change as a dramatic dismantling of what was historically one of the agency’s most aggressive enforcement regimes. With indications that the SEC is retreating from previously strict enforcement, Stark suggests that "the message to the world has been clear: a total reset of the SEC’s approach to crypto." This change in direction coincides with the exit of former SEC chair Gary Gensler, who has been replaced—at least temporarily—by Mark Uyeda.

Former President Donald Trump had long criticized Gensler’s approach to cryptocurrency regulation, vowing to replace him if elected. Trump’s outspoken support for the crypto sector during his campaign was celebrated by many in the industry, and his advocacy even buoyed Bitcoin prices to an all-time high on his inauguration day. However, the market saw a decline of over 25% due to various policy decisions since then.

With this new wave of regulatory leniency, industry insiders are optimistic about the future. Many believe that a clearer regulatory framework will foster innovation, build trust, and enhance the user experience in the crypto space. As Alex Saunders from Citigroup notes, “Clarity on regulation should deliver more opportunities to innovate.”

For years, the crypto sector felt stifled under stringent regulatory oversight. Executives at companies like Coinbase and Ripple sought greener pastures abroad, where jurisdictions in Europe, the Middle East, and Asia rolled out more favorable regulations. But now, as the SEC pivots, Ripple has begun advertising a significant portion of its job openings back in the U.S.—a sign that optimism is returning.

Concerns over unpredictable enforcement actions have eased. Cathy Yoon, general counsel at the Wormhole Foundation, highlighted that the once-persistent fear of arbitrary SEC actions seems diminished. The SEC has recently revamped its crypto division, launching a Cyber and Emerging Technologies Unit and establishing a dedicated task force focused on developing regulations in collaboration with industry experts.

The ongoing conversation about whether crypto assets are classified as securities or commodities is also evolving. With the SEC’s renewed focus, exchanges that previously delisted assets are revitalizing trading options for clients, reflecting a growing acceptance of these digital currencies. Furthermore, the agency has become more receptive to applications for exchange-traded funds (ETFs) tied to cryptocurrencies, a move many in the industry see as a positive step forward.

In a recent demonstration of its evolving stance, the SEC clarified that memecoins—tokens based largely on internet memes or trends—would not be considered securities under its supervision. Trump himself had launched a memecoin, showcasing the murky relationship between politics and the crypto market.

Interestingly, many individuals close to Trump have seen their regulatory troubles evaporate alongside the SEC’s new direction. For example, Justin Sun, a high-profile crypto entrepreneur, and Gemini Trust Co. have experienced their respective cases against them being dismissed without action.

However, it’s essential to note that the SEC’s new approach doesn’t equate to a free-for-all for investors. Joe Castelluccio from Mayer Brown cautions that the agency remains vigilant, ensuring that retail investors are protected from scams, maintaining its commitment to guarding market integrity.

As the regulatory landscape stabilizes, former Commodity Futures Trading Commission chair J. Christopher Giancarlo predicts an uptick in enforcement activities targeting actual fraud and manipulation while allowing the innovation that defines the crypto ethos to flourish.

While the SEC’s shift may create new opportunities, challenges remain. The crypto space is still rife with risks, as illustrated by the recent theft of nearly $1.5 billion in assets from the exchange Bybit and scandals involving memecoins, leading to substantial investor losses.

As the dust settles from these seismic changes, the general sentiment in the crypto community leans toward cautious optimism. As Dan Hughes from Radix DLT points out, while regulatory action can impede progress, a more relaxed approach is a double-edged sword, potentially opening the door to both innovation and misconduct.

The future of cryptocurrency in the U.S. holds vast potential, but as we navigate this new terrain, it’s critical for investors to stay informed and vigilant. At Extreme Investor Network, we are committed to providing you with the latest insights and analyses to help you make informed decisions in this ever-evolving landscape. Stay tuned for more updates!