Analyzing AMD’s Stock Potential: Is It Time to Invest?

In the fast-paced world of technology investments, Advanced Micro Devices (NASDAQ: AMD) has certainly caught the attention of many investors over the past five years. An initial investment of $1,000 half a decade ago has burgeoned into approximately $2,200 today, showcasing a 118% growth in share price. However, this performance trails behind the 178% increase recorded by the PHLX Semiconductor Sector index during the same period.

Facing Challenges Amidst Growth

Despite its historical gains, the past year has been particularly challenging for AMD, with its stock price plummeting 41%. This decline can largely be attributed to the company’s struggle to leverage the escalating demand for artificial intelligence (AI) chips, an area where competitors like Nvidia have shown a formidable presence.

However, it’s essential to highlight that AMD’s recent results have been favorable, revealing multiple catalysts that could potentially invigorate its stock price over the next five years. Understanding these growth drivers is crucial for investors considering a buy-and-hold strategy in AMD.

Mixed Financial Performance

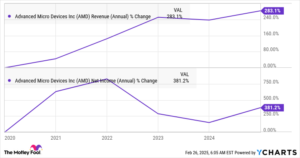

AMD’s financial trajectory over recent years reflects a mixed bag. The company saw revenue and earnings soar in the peak years of 2020, 2021, and 2022, primarily due to robust sales of its central processing units (CPUs) and graphics cards for personal computers. Yet, the tail end of this success narrative has faced headwinds, primarily due to a decline in PC demand as pandemic-driven sales slowed.

Consequently, AMD has had to confront excess inventory write-downs, which adversely impacted its earnings. In contrast, its data center business has thrived, consistently gaining market share against Intel.

The Gaming Sector’s Evolving Landscape

AMD has faced stiff competition in its gaming sector, particularly with the maturation of gaming console sales from Sony and Microsoft. This phenomenon has resulted in reduced orders for its semi-custom processors, placing additional strain on AMD. Moreover, with a mere 10% market share in the lucrative gaming graphics card arena compared to Nvidia, it’s evident why AMD has struggled to gain momentum in this segment.

Despite these challenges, there are positive developments on the horizon. Both Sony and Microsoft are expected to launch new gaming consoles by 2026 or 2027, which may significantly bolster AMD’s semi-custom chip business, as the company has reportedly been selected to supply the processors for these next-generation consoles.

Bright Prospects for PCs and Data Centers

The PC market is also displaying promising signs of recovery. AMD has recently seen its client segment revenue surge by 52%, achieving a record $7.1 billion, driven mainly by strong demand for its Ryzen processors. With the rise of generative AI, the PC market is projected to grow significantly, with estimates suggesting a revenue increase of nearly 5x from 2024 to 2030. This growth presents a fantastic opportunity for AMD, which aims to capture a larger share of this evolving market.

Furthermore, the company’s data center revenue saw a substantial rise to $12.6 billion, bolstered by impressive sales of server CPUs and GPUs. AMD anticipates that its GPU sales could escalate to "tens of billions" in revenue in the coming years, positioning itself competitively even if it captures only a fractional share of the booming AI-driven data center market.

Conclusion: A Compelling Investment Opportunity

Overall, AMD appears poised for robust earnings growth over the next five years. With a price/earnings-to-growth (PEG) ratio of just 0.42, the stock currently stands out as undervalued relative to its projected growth. A PEG ratio under 1 signifies potential for significant upside, making AMD an intriguing candidate for growth-focused investors at this juncture.

As we navigate this dynamic tech landscape, investing in AMD could be a strategic move for those looking to capitalize on its upcoming growth opportunities. The technological advances in gaming, PC development, and data centers suggest that AMD could well rise to the occasion, attracting both new and seasoned investors.

Don’t Miss Out on Potential "Double Down" Opportunities!

If you often feel like you’ve missed lucrative investment opportunities in the past, remember that our expert analysts at Extreme Investor Network regularly signal “Double Down” stock recommendations. These promising stocks have shown potential for explosive growth.

Take a look at some fascinating investment success stories:

- Nvidia: An investment of $1,000 back when we doubled down in 2009 would have grown to $323,920.

- Apple: An initial $1,000 investment in 2008 would now be worth $45,851.

- Netflix: A $1,000 investment from our recommendation in 2004 is now valued at an astonishing $528,808.

Don’t let this chance slip away! We’re currently issuing “Double Down” alerts for three impressive companies, and you won’t want to miss this opportunity again.