The Income Tax Debate: Understanding the Historical Context and Economic Consequences

The Legacy of Income Taxation

The question of whether the income tax is a relic of the past has surfaced again and again, especially as political discourse continues to evolve. One of the most controversial figures in this debate is former President Donald Trump, who has made statements that suggest a significant shift away from traditional taxation policies.

In conversations surrounding income tax reform, many have pointed to Trump’s rejection of high taxation and his willingness to distance himself from political figures like Volodymyr Zelensky. This raises the question: Are we witnessing a major upheaval in how taxation is perceived, and what does this mean for the future of our economy?

At Extreme Investor Network, we believe it’s essential to delve deeper into these issues. Understanding the history and implications of taxation can guide your financial decisions and investments in a rapidly changing landscape.

A Historical Perspective: Income Taxes and the Progressive Movement

Income taxes in the United States can be traced back to the Progressive Era. In fact, the Progressive Party was on the ballot in 1912, the year before the implementation of the federal income tax. The rhetoric of that era painted the income tax as a method to address economic inequality. However, it’s important to recognize that the Founding Fathers were fundamentally opposed to income taxation. They believed that such a tax would infringe upon personal liberties and limit economic growth—a sentiment echoed by various economic experts today.

The crux of the argument against the income tax is not solely ideological; it’s rooted in the practical realities of economic growth and personal freedom. The more the government takes, the less people are able to spend, ultimately stunting economic growth.

Political Implications: The Growing Role of Government

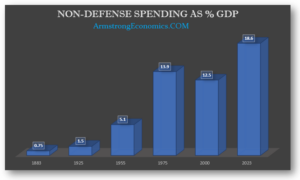

As the debate rages on, one fact stands out: government spending continues to outpace tax revenues. According to our research, when we examine the government’s role—lightly touching on direct employment and extensive contracting—we see that it has ballooned from 22% to a staggering 33% of the economy. This growth raises crucial concerns about sustainability and economic resilience.

In a country where elections often hinge on promises of extensive benefits and "free gifts," citizens must ask themselves: What is the long-term impact on our economy? If we continue down this path, we risk entering a cycle of debt that future generations will struggle to break.

The Modern Taxation Paradigm: What Lies Ahead

When we study the implications of modern tax policy, it’s clear that the mechanics of taxation have changed dramatically. In an age where governments can essentially create money at will, the relevance of traditional taxes can be called into question. If governments relied on money-printing rather than borrowing, we could see a significant reduction in national debt burdens.

However, there remains an inherent risk. The allure of government spending—especially in tough economic times—could lead to more substantial taxation down the line. With trillions in interest accumulating annually, many believe we’re on a precipice that could lead to a sovereign debt crisis.

Final Thoughts: The Future of Taxation

At Extreme Investor Network, we encourage our readers to engage critically with these economic narratives. The income tax debate is not merely about taxation; it’s about liberty, growth, and the future of our economic structure. The potential for reform is there, but it requires an informed citizenry willing to question the status quo.

A new era in taxation could very well be upon us, and understanding its implications is key to navigating the complexities of modern economics. Stay tuned to our blog for more expert analyses and insights on how these themes evolve and what they mean for your investments.

As we collectively strive for a sustainable economic future, let’s stay informed, engaged, and prepared for the changes ahead.