The Rising Tide of Legal Concerns in Washington D.C.: What It Means for Investors

At Extreme Investor Network, we aim to provide deeper insights that help you navigate the current economic landscape. As recent data highlights an intriguing shift in public behavior in Washington D.C., it’s crucial to understand the implications for both individual investors and institutions.

A Surge in Legal Terminology Searches

According to WikiLeaks and Google Trends, searches for terms such as “lawyer” have skyrocketed by 400% in D.C. since Donald Trump took office. While the elite in the capital already have their legal defenses in place, the remarkable uptick indicates a broader concern among lesser-known figures and aids who are suddenly searching for ways to secure themselves amidst a whirlwind of political change.

It’s also noteworthy that searches for “Swiss bank,” “wire money,” “IBAN,” and “offshore bank” have surged, hinting at a growing interest in banking secrecy and asset protection. With greater scrutiny on financial dealings, it’s no surprise that many are looking for ways to move funds away from the watchful eyes of financial regulators.

The Curious Increase in “Wipe" and “Erase" Searches

What’s even more alarming is the simultaneous spike in searches for terms like “wipe” and “erase.” Such terms often reference tactics used to eliminate digital footprints, suggesting individuals are becoming increasingly concerned about how their actions and digital behaviors could be scrutinized.

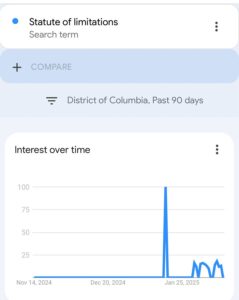

Adding to this mix is the notable rise in searches for “statute of limitations." For anyone involved in legal issues, familiarity with the constraints on prosecution timelines is crucial. For example, the Federal Tort Claims Act requires a claim to be filed within two years of an incident. With the complexities of justice in D.C., time is of the essence for those seeking to avoid accountability.

Disturbing Legal Protections in D.C.

It’s essential to recognize the two-tier system of justice that seems to exist; those in public service often find themselves shielded from consequences that would otherwise affect everyday citizens. The statute of limitations for treason, for instance, is a mere five years, raising questions about accountability and the enforcement of laws designed to protect the public from wrongdoing by those in power.

Real Estate Market Shifts: The “Trump Bump”

As political uncertainty drives change, we’re witnessing an exodus of high-net-worth individuals from D.C. The trend of increasing luxury home sales—dubbed the “Trump Bump”—sees a significant uptick in properties over $5 million. While only a handful of such homes were on the market last year, November and December recorded 20 sales with multiple cash offers.

This movement isn’t just about wealth leaving; rather, it’s indicative of broader shifts in sentiment that can influence market conditions. Investors should take heed of these changes as they reflect deeper economic trends that could shape future opportunities in real estate and beyond.

Conclusion: Navigating the Storm

As Washington D.C. finds itself in the midst of unprecedented turmoil, it’s imperative for investors to remain vigilant and informed. The trends we’re seeing—the surge in legal searches, the focus on banking privacy, and the real estate shifts—are all signals of larger economic forces at work.

At Extreme Investor Network, we’re dedicated to unraveling these complex narratives and providing actionable insights to help you make informed decisions. Stay connected with us for ongoing analysis and updates that matter to your investment strategies. Remember, knowledge is power, especially in an era where secrets are being unearthed, and the status quo is under threat.

Join our community today and ensure you’re always one step ahead in the game!