Nvidia’s Resilience Amidst Market Turbulence: What Investors Need to Know

Despite a tumultuous trading environment, where Nvidia (NVDA) is grappling with significant sell-offs, one of Wall Street’s most ardent bulls, Vivek Arya from Bank of America (BofA), remains unwavering in his support for the tech giant. In a compelling analysis, Arya has reiterated Nvidia as his top stock pick for 2025, asserting his price target of $190, which suggests a robust 57% upside from its current levels.

Arya’s bullish stance comes just ahead of Nvidia’s earnings report slated for February 26, a potential inflection point for investors. According to his insights, this earnings call could mark a pivotal moment for investor sentiment. He outlines three key predictions that could drive positive sentiment:

-

Blackwell Execution Assurance: Arya expects Nvidia to reassure investors on its execution of the Blackwell architecture, which is designed to bolster its AI and computing capabilities.

-

Impressive Year-Over-Year Growth: Arya anticipates that Nvidia will signal confidence in achieving over 60% year-over-year growth in data center sales for fiscal 2026 and calendar 2025. This figure, while promising, also indicates there’s still room for growth; Taiwan Semiconductor anticipates AI growth to soar by over 100% in the same timeframe.

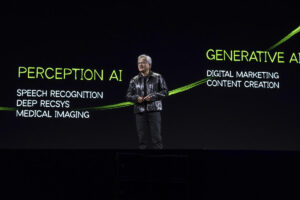

- Anticipation Surrounding GTC Conference: The upcoming flagship GTC Conference on March 17 is likely to create excitement as Nvidia unveils its extensive product pipeline, including innovations like GB300 and Rubin, alongside its foray into physical AI applications such as robotics.

In discussing the long-term outlook, Arya has boldly described Nvidia as a "generational investment.” His sentiments echo a broader belief in Nvidia’s fundamental strength, although they have not resonated with the market thus far this year.

Market Concerns: The Impact of New Competitors

However, it’s critical to understand the headwinds that Nvidia faces. Recently, the emergence of China-based DeepSeek has stirred the pot, as it unveiled its AI model named RI. This model is reported to compete with U.S. counterparts like ChatGPT, but at a staggering fraction of the cost—around $5.6 million to develop versus the hundreds of millions often cited for models from U.S. companies like OpenAI.

This revelation sparked fears that U.S. companies might be overspending on AI infrastructure, including Nvidia’s essential chips, shaking investor confidence.

The Expanding Competitive Landscape

Adding to these concerns is the aggressive foray of Big Tech into the AI space. Major players like Amazon, through its $8 billion partnership with Anthropic, and Google with the launch of its AI chip-powered supercomputer, Willow, are looking to capture a slice of Nvidia’s hefty market share. This competitive landscape is becoming increasingly crowded as companies like Broadcom and Marvell also roll out their custom chips designed to challenge Nvidia’s dominance.

As Microsoft co-founder Bill Gates remarked in an interview, Nvidia’s unique position—where it doesn’t produce its own chips but relies on suppliers like Taiwan Semiconductor—adds a layer of complexity. He noted the brilliance in Nvidia’s design strategy but also highlighted the risk, stating, “I wouldn’t want to be Jensen necessarily because other people are working on the same things.”

Conclusion: Navigating the Future of Nvidia

With these dynamics at play, investors in Nvidia must remain vigilant. Understanding the implications of new competitors, alongside the potential catalysts highlighted by Arya, is crucial for those considering a position in the stock. As the earnings call approaches, and anticipation builds surrounding the GTC Conference, the next few weeks could prove critical in defining Nvidia’s trajectory.

At Extreme Investor Network, we are committed to providing you with the latest insights and analyses, enabling you to navigate the complexities of the investment landscape equipped with the information you need to make informed decisions. As the market evolves, we’ll continue to monitor Nvidia’s progress and provide updates that matter. Stay tuned for more insights and strategies to enhance your investment journey!