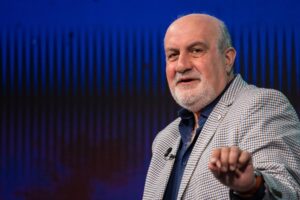

Brace for Impact: Nassim Taleb Warns of Dangers in AI-Driven Stock Market Rally

In the ever-volatile world of finance, wisdom often comes from those who dare to venture into uncharted waters. Nassim Taleb, renowned for his best-selling book "The Black Swan," recently weighed in on the significant market dynamics following Nvidia Corp.’s staggering decline. The sell-off, which showcased a dramatic 17% drop, is just a hint of the turbulence that could lie ahead for investors who have jumped headfirst into the artificial intelligence-driven market frenzy.

Taleb cautioned that future market pullbacks could be two to three times greater than Nvidia’s recent slump, which erased a jaw-dropping $589 billion from the company’s valuation. He labeled this drop as the largest in market history, marking a critical juncture for investors who have become overly reliant on a single narrative: the illusion of perpetual growth in AI stocks.

“This is the beginning,” Taleb remarked in a recent interview, emphasizing that the market adjustments are forcing investors to confront an uncomfortable reality. The once-impenetrable facade surrounding AI’s dominance has developed cracks, with emerging competitors like the Chinese AI startup DeepSeek raising alarms about the sustainability of US tech giants’ supremacy.

Investors are beginning to grapple with the genuine risks within the industry. Taleb’s perspective implies that the 17% retreat is merely scratching the surface. He strongly believes that shooting star stocks, such as Nvidia, have become unsustainable and that over-reliance on these high-flying tech narratives must be revisited.

The Call for Crash Protection

Taleb, who serves as a scientific advisor at Universa Investments, a hedge fund specialized in tail-risk strategies, outlines an approach that contrasts with the mainstream "buy and hold" mentality. Rather than suggesting a complete exodus from the market—which, after all, has surged nearly 50% amid the AI wave—he advocates for strategic allocation of a portion of one’s portfolio to protective positions against unexpected market shocks.

This concept of "crash protection" is vital. Taleb argues that too many investors are engaging in speculation by pushing up prices of technology firms without fully understanding the underlying mechanisms that ensure their success. He refers to these investments as “gray swans,” highlighting that the market’s behavior is rarely predictable—price deviations can be steep, and investors often underestimate such risks.

Addressing Broader Economic Concerns

Moreover, Taleb’s warnings extend beyond the tech sector. He raised significant concerns regarding the unsustainable nature of US government debt. He warns of a potential inflationary explosion should labor costs rise concurrently with aggressive tariffs on imports. Given this precarious economic backdrop, he starkly advised against relying on bonds as a safe haven for investment.

Final Thoughts

Nassim Taleb’s insights serve as a critical reminder for investors navigating the complex waters of today’s financial landscape. As we witness the evolution of the AI market, staying informed and vigilant can be the difference between profit and peril. At Extreme Investor Network, we encourage our community to consider protective strategies while remaining open to growth opportunities—because in a world where black and gray swans lurk, preparation is indeed the best policy.

This revised content not only captures Taleb’s critical warnings but also integrates valuable knowledge that emphasizes well-informed investment strategies. Stay tuned to Extreme Investor Network for more insights and strategies that can help you navigate today’s chaotic markets.