The Current Cryptocurrency Landscape: Why Now Is the Time to Invest

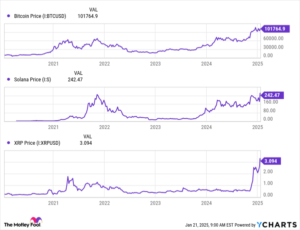

As the cryptocurrency market continues to evolve, major players like Bitcoin (CRYPTO: BTC), Solana (CRYPTO: SOL), and XRP (CRYPTO: XRP) are once again approaching their all-time highs. For seasoned cryptocurrency investors, this is an exhilarating time filled with potential, especially with pivotal developments on the horizon that could transform the market landscape.

Key Catalysts on the Horizon

-

The Prospect of a Strategic Bitcoin Reserve

There’s been widespread speculation following the new administration’s discussion of a Strategic Bitcoin Reserve (SBR). If implemented, this could serve as a powerful endorsement for Bitcoin from the U.S. government itself in the early months of 2025. As we know, government backing has a way of validating assets and can significantly influence investor sentiment. Should the SBR come to fruition, we could see Bitcoin solidify its position as a major player in the financial markets.

-

Expanding Beyond Bitcoin: A National Cryptocurrency Repository?

Recently, the conversation around the SBR has broadened to include a potential national cryptocurrency repository, which implies the government could also invest in other significant U.S.-based cryptocurrencies like Solana and XRP. Such a move would not only lend credibility to these assets but would also introduce substantial buying pressure and market stability, driving up prices across the board.

-

The Impact of Declining Interest Rates

The sensitivity of cryptocurrencies to changes in borrowing costs cannot be overstated. Historically, lower interest rates encourage investors to seek higher returns in riskier assets like cryptocurrencies. As central banks globally, including the Federal Reserve, are poised to reduce rates, this presents an environment ripe for an influx of capital into the crypto space. The trend could see significant growth in the value of Bitcoin, Solana, and XRP in the near future.

Market Sentiment: The Bear Market Blues

Bear markets often foster an air of pessimism among investors, leading to missed opportunities. It’s crucial to recognize the cycle: after a downturn, it can take time for market participants to regain their confidence. Interestingly, many who purchased during the frenzied highs of 2021 are now in a position of potential profit, offering a glimmer of hope for a bullish turnaround.

Historically, it takes sustained performance metrics to restore optimism. As we analyze the current trajectories of Bitcoin, Solana, and XRP, it appears these cryptocurrencies are bouncing back, indicating that investor sentiment may soon shift positively.

Ready to Seize the Moment?

Investors tend to regret inaction during moments of market recovery. If you’ve ever feared missing out on lucrative opportunities, now may be your time to act. Our expert team at Extreme Investor Network frequently issues “Double Down” stock alerts for companies poised to make significant gains.

For context, let’s look at historical successes from our alerts:

- Nvidia: An investment of $1,000 at the right time could have grown to $381,744!

- Apple: A $1,000 investment when we doubled down would now be worth $42,357!

- Netflix: Starting with $1,000 back in 2004 could have ballooned to $531,127!

Currently, we’re issuing alerts for three companies we believe are on the verge of substantial growth. Don’t let this opportunity pass you by!

Conclusion

In summary, the cryptocurrency market is poised for a resurgence, driven by potential government-backed initiatives and favorable financial conditions. The current landscape represents a unique moment for investors who are willing to take calculated risks. As you consider where to allocate your resources, remember the monumental shifts that could occur as we move into 2025. Stay informed, stay engaged, and seize the day with insights from Extreme Investor Network—your guide through the complexities of the finance world.

Disclaimer: Investment in cryptocurrencies involves risks, and you should always consider your financial circumstances and conduct thorough research before making investment decisions.