Gold’s Resilience Shines Amid Economic Uncertainty: An Extreme Investor Network Perspective

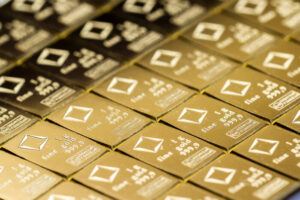

In today’s dynamic marketplace, where uncertainty looms large due to shifting geopolitical landscapes and economic fluctuations, investors continuously seek refuge in assets that historically offer stability. Among these, gold remains the unparalleled safe-haven asset, garnering strong interest from market participants who are preparing for potential disruptions in global trade.

Fed Rate Cut Expectations Bolster Gold’s Momentum

Recent market speculation suggests that the Federal Reserve could cut interest rates up to two times this year. This prospect has ignited a bullish momentum for gold, which many analysts deem as a reliable hedge against economic volatility. Easing inflationary pressures in the U.S. have increased the likelihood of such monetary policy adjustments, making gold an attractive investment during these uncertain times.

“Gold remains well-positioned as investors anticipate rate cuts to support economic growth,” stated a senior market strategist at one of the leading investment firms. This sentiment reflects a growing consensus that lower interest rates could spur demand for non-yielding assets like gold, further establishing its value in an investment portfolio.

Even as U.S. Treasury yields showed a modest recovery—pulling up to 4.12%—which buoyed the U.S. Dollar (USD) from a recent two-week low, gold’s upward trajectory appears largely intact. The complexity of these interrelations highlights how gold can serve as an effective counterbalance in times of economic fluctuation, despite external pressures from rising Treasury yields.

Silver Faces Pressure Amid a Stronger Dollar

Contrasting the momentum enjoyed by gold, silver (XAG/USD) has experienced its own set of challenges. Trading around $30.91—after dipping to an intra-day low of $30.73—silver’s performance has been adversely impacted by the stronger U.S. dollar and shifting Fed rate expectations. Unlike gold, silver’s value is closely tied to its industrial demand, making it more susceptible to economic slowdowns.

Analysts warn that the pressure on silver could reflect a broader trend in the market. In times of economic uncertainty, investors often gravitate toward gold, deeming it a safer asset, while silver’s dual role as both a precious metal and an industrial component places it in a more vulnerable position.

Why Choose Extreme Investor Network for Your Market Insights?

At Extreme Investor Network, we provide comprehensive analyses designed to guide your investment strategy during these complex times. Our expert insights delve deeper than the surface-level indicators, exploring the driving forces behind market movements to better arm you with the knowledge you need.

Additionally, we offer intuitive perspectives on other asset classes and sectors, ensuring you have a holistic view of what’s influencing the market landscape. With a commitment to delivering timely and actionable data, we aim to empower our readers, making informed investment decisions possible.

As we navigate fluctuating market dynamics, stay ahead of the curve by leveraging our detailed commentary and expert forecasts. Trust Extreme Investor Network to be your ally in understanding the intricacies of the stock market, trading strategies, and the overarching economic environment.