Market Reactions to Trump’s New Policies: A Mixed Bag for Investors

Shares of Tesla Inc. took a significant hit on Tuesday, joining a broader decline among electric vehicle (EV) makers. Conversely, stocks in the space industry soared, spurred by fresh promises from President Donald Trump that could reshape market dynamics. Investors are left to ponder the future implications of these new policies.

Tesla and the Electric Vehicle Sector Under Pressure

Tesla’s stock tumbled by as much as 4.7%, making it one of the largest detractors from the S&P 500 Index for the day. The decline came on the heels of Trump’s administration contemplating the reduction or removal of various EV subsidies and favorable policies—a development that could hinder Tesla’s growth and profitability. Other EV startups, such as Rivian Automotive and Lucid Group, experienced similar downturns, with the Bloomberg Electric Vehicles Index dropping by 1.7%.

While specifics about potential changes to Environmental Protection Agency regulations have yet to be laid out, investors are clearly concerned about the potential for reduced incentives in the rapidly growing EV market. As we assess these developments, it’s important to consider how this might impact investment strategies moving forward.

Tariff Talks and Broader Market Volatility

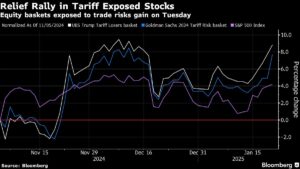

In addition to the pushback on EV incentives, Trump announced plans to impose a 25% tariff on imports from Mexico and Canada, effective by February 1. Walter Todd, president and chief investment officer at Greenwood Capital Associates, highlighted that the market’s sensitivity to these headlines could lead to increased volatility across various financial sectors.

JPMorgan Chase & Co. is reportedly setting up a "war room" to monitor and manage the impact of these policies on investment decisions. However, it’s worth noting that companies typically seen as vulnerable to tariff risks seem relatively unfazed thus far, indicating a complex market sentiment at play.

Space Sector Shows Promise

While the electric vehicle sector struggles, space-related stocks saw remarkable gains thanks to Trump’s ambitious vow to launch American astronauts to Mars. Companies like Intuitive Machines Inc., which recently led a historic moon landing effort, saw their shares surge by as much as 23%. Rocket Lab USA and Redwire Corp. also enjoyed double-digit increases, making this sector one to watch for investors looking for growth opportunities amid broader market unpredictability.

Cryptocurrency Market: A Wait-and-See Approach

Interestingly, the administration hasn’t yet acted on the cryptocurrency front, leaving investors in that sector in a state of anxious anticipation. Despite a lack of supportive news for digital assets from Trump’s first day in office, Bitcoin managed to gain over 3%, hovering around $106,000, while stocks connected to cryptocurrencies like MicroStrategy exhibited volatility without any major directional shifts.

Before the inauguration, reports surfaced that the President was considering an executive order elevating cryptocurrencies to a "national priority." Moreover, new personal memecoins were unveiled by Trump and Melania, injecting a modicum of intrigue into the crypto space.

Conclusion: What Lies Ahead for Investors?

As we transition into what many are calling "Trump 2.0," it is imperative for investors to stay informed and responsive to the ever-evolving landscape of policies. Market sensitivity remains high, and strategies must be adaptable. Given these developments, our advice at Extreme Investor Network is to not only focus on traditional sectors like EVs and aerospace but to also explore emerging opportunities in the cryptocurrency market, which may prove resilient even amid governmental scrutiny.

This volatile market environment calls for comprehensive portfolio management that takes into account both risks and opportunities. Stay tuned to our platform for ongoing analysis and expert insights that can guide your investment journey in these dynamic times.