Nvidia’s Market Value Surge: What Lies Ahead for Investors?

In just two years, Nvidia Corp. has witnessed an extraordinary rise, accumulating a staggering $3 trillion in market value—an unprecedented spike in stock history. This meteoric surge can be traced back to the AI boom triggered by the introduction of ChatGPT and other technologies. However, as the landscape shifts, investors need to understand the challenges and opportunities that lie ahead for one of the most influential players in the AI chip market.

The Evolving Competitive Landscape

Nvidia’s dominance in AI chips is increasingly under threat as both competitors and clients ramp up their efforts to carve out their share in this booming market. Although the revenue growth for AI has been remarkable, signs of a slowdown are starting to appear. The Biden administration’s intention to limit sales of Nvidia’s advanced chips internationally adds another layer of uncertainty—not to mention the prospective shifts in policy with Donald Trump potentially resuming office.

Despite these challenges, investors remain optimistic about Nvidia’s future, anticipating that the ongoing influx of spending on AI computing could inflate its market value by hundreds of billions more by 2025. Industry experts, like Kevin Mahn of Hennion & Walsh Asset Management, believe Nvidia still has several avenues for growth, albeit with a side order of volatility linked to its ambitious journey through the AI revolution.

Recent Volatility and Its Implications

The company’s stock recently experienced a downturn after CEO Jensen Huang’s presentation fell short of lofty investor expectations. Shares declined in consecutive sessions, shedding approximately 12% from their peak. However, investment analysts suggest that such fluctuations are to be expected in a sector characterized by rapid innovation and substantial risk.

Joanne Feeney, a portfolio manager at Advisors Capital Management, remarked that Nvidia is likely to continue this significant growth trajectory over the coming years, despite the inherent volatility. Analysts predict an impressive 30% rise in Nvidia’s shares over the next year, potentially elevating its market value beyond a whopping $4 trillion, surpassing tech giants Apple and Microsoft.

Navigating the Risks Ahead

As Nvidia forges ahead, several critical challenges demand attention:

1. Dependency on AI Spending:

Nvidia’s growth is closely tied to the demand for AI services. Nearly 50% of its revenue is sourced from major tech companies eager to expand their computing capacity. Projected capital expenditures from these giants—Microsoft, Amazon, Google, and Meta—are anticipated to reach $257 billion, up from $209 billion last year. If these firms underperform or reduce expenses in the face of economic realities, Nvidia could face significant headwinds.

Gil Luria, head of technology research at D.A. Davidson, emphasized the need for new applications to drive revenue growth beyond merely spending on hardware.

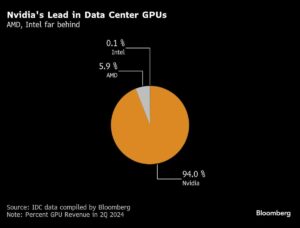

2. Fierce Competition:

While Nvidia currently enjoys a virtual monopoly in AI accelerators, competitors are not idling. Advanced Micro Devices (AMD) is positioning itself as a formidable adversary, with its AI accelerator sales projected to exceed $5 billion in 2024. Even Intel, which has had its challenges, is escalating its ambitions in the AI chip market.

However, cutting-edge offerings like Nvidia’s latest Blackwell chips appear to retain an edge in technological advancement. In a recent analyst report, Morgan Stanley experts highlighted that competing with Nvidia at a cluster level remains a significant challenge for other players in the market.

3. Cost Structure and Valuation Pressure:

Investors will closely watch Nvidia’s profits as it navigates higher development costs associated with Blackwell. While its growth outlook remains promising, the current share price of 31 times projected profits is still below its historical average. A slowdown in AI investment could arouse skepticism toward Nvidia’s valuation, potentially leading to a drop in share prices.

Nvidia’s sales are projected to grow substantially, with expectations for a 112% increase in fiscal 2025 and a 53% rise the following year. Nonetheless, if macroeconomic factors curb AI spending, the anticipated growth might not materialize as expected.

Conclusion: Eyes on the Future

There’s no doubt that Nvidia carries tremendous potential as the market for AI services continues to expand. The coming year will be pivotal as the company grapples with the dual pressures of invigorated competition and dependency on customer spending. While the prospects for growth are robust, all eyes are on Nvidia’s next moves and its ability to maintain its dominant position in a rapidly evolving tech landscape.

For investors considering where to place their bets, understanding these dynamics will be crucial in navigating the complexities of the AI chip revolution. At Extreme Investor Network, we are dedicated to providing insights to help you stay informed and make educated investment decisions in these volatile markets.