—

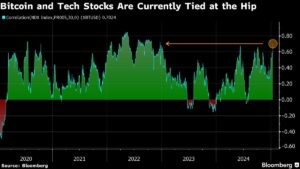

The recent surge in the correlation between Bitcoin and the Nasdaq 100 Index presents a compelling narrative for investors navigating the volatile waters of digital assets and technology stocks. As of now, the 30-day correlation coefficient between Bitcoin and the Nasdaq is hovering around 0.70, indicating a strong alignment in their movements. This high correlation hasn’t been witnessed in two years, suggesting that the dynamics of the equity market are significantly influencing Bitcoin’s trajectory.

With the US inflation data set to be released soon, the market is poised for potential reactions that could impact both traditional equities and cryptocurrencies alike. A reading of 1 in the correlation coefficient suggests assets are moving in lockstep, while -1 represents an inverse relationship. In the current environment where economic indicators are particularly sensitive, the impending inflation report may serve as a catalyst for market shifts.

Investors are anticipating that the inflation data will indicate robust price pressures, a scenario that has market watchers concerned about the implications for the Federal Reserve’s monetary policy. Recent commentary has highlighted that the Federal Reserve may have limited scope for further interest-rate cuts against the backdrop of a resilient US economy and the unpredictability of forthcoming policies from the new administration.

Currently, Bitcoin’s price is at approximately $97,000—about $11,300 shy of last month’s record high. This decline coincides with rising bond yields and a strengthening dollar, which historically exerts downward pressure on both stocks and cryptocurrencies. As traders and investors alike ponder the trajectory of Bitcoin in this shifting landscape, attention is also drawn to the unfolding political scene.

President-elect Donald Trump will be inaugurated soon, and speculation is rife regarding the potential for a policy blitz that could shake up the market. Traders are weighing the risks of inflationary measures, including tariffs and immigration policy adjustments, against the President’s ambitious pledges to position the United States as a global leader in cryptocurrency.

In the words of K33 Research analysts Vetle Lunde and David Zimmerman, “The overall sensitivity to interest rates over the past month suggests increased importance of Wednesday’s CPI print.” They further note that the momentum surrounding Trump’s policies may increase as the inauguration approaches, which could swing investor sentiment in one direction or the other.

Moreover, hedging activity is gaining traction in the options market, reflecting a cautious mood among investors who are bracing for heightened volatility. Sean Dawson, Head of Research at Derive.xyz, pointed out that the rising proportion of bearish bets suggests many are preparing to hedge against potential downside risks leading up to the inauguration.

For those looking to navigate this complex landscape, it’s critical to stay informed and aligned with market movements. At Extreme Investor Network, we encourage our readers to remain vigilant in understanding both market trends and the external factors influencing them. Leveraging in-depth analysis and real-time market data can provide the critical insights needed to make informed investment decisions.

Stay connected with us for continued updates and expert insights as the situation develops. Making sense of these dynamics will empower you to strategically position your portfolio, allowing you to capitalize on opportunities and mitigate risks associated with the intertwining of cryptocurrencies and traditional equities.

—

In this rewritten format, the information is presented in a blog style, incorporating valuable insights related to market behaviors and trends while encouraging readers to engage with your content as a trusted source of information.