SoftBank and Arm Set Their Eyes on Ampere Computing: An Insight into the Semiconductor Landscape

In the rapidly evolving world of technology, recent developments have revealed that SoftBank Group Corp. and its majority-owned Arm Holdings Plc are reportedly in discussions to acquire Ampere Computing LLC, a semiconductor designer backed by Oracle Corp. This potential deal signals significant interest in the semiconductor sector, particularly as the demand for cutting-edge technology continues to soar.

Implications of the Deal

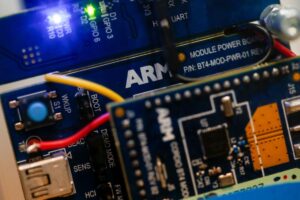

Ampere has been making headlines for its innovative semiconductor designs tailored for data centers, leveraging Arm’s technology in its products. The company’s strategic exploration for options indicates a push towards consolidating its position in a market that is becoming increasingly competitive. While negotiations are currently underway, there remains a possibility that the talks might fall through, or that another suitor may emerge.

In 2021, Ampere was valued at around $8 billion following interest from SoftBank. However, the current discussions do not disclose updated valuations, illustrating how fluid and dynamic the market can be.

The AI Chip Race

The semiconductor industry is experiencing an AI-fueled boom, with various companies aiming to capitalize on the increased investment in artificial intelligence technology. This trend has made the competition notably fierce, as both Tech giants and smaller firms race to create chips tailored for AI applications. Ampere, which previously contemplated going public as a way to harness capital for its growth, might now see its optimal path through consolidation with a larger player.

With Oracle owning a 29% stake in Ampere, their position could influence potential terms of the deal, and they may opt to exercise rights for future investments that grant them control of the chipmaker.

Navigating the Competitive Landscape

Currently, Ampere finds itself at a crossroads. While the company stands to benefit from the ongoing increase in AI-related spending, it faces intense competition from established companies such as Intel and AMD. The market is pivoting away from traditional central processing units (CPUs) to more specialized chips, particularly those crafted by NVIDIA, which adds another layer of complexity to Ampere’s future in the data center arena.

Additionally, Ampere’s evolution from a company that primarily licensed Arm technology to one that is moving towards being a complete chipmaker aligns with broader trends in the industry. This shift means the integration of Ampere’s engineering talent—many of whom hail from Intel’s server chip unit—could be a strategic advantage for Arm as it seeks out new opportunities in this lucrative market.

Future Trajectories

Renee James, Ampere’s founder and CEO, has previously indicated interest in an IPO; the company even filed confidentially for one around April 2022. However, a sale to a larger entity might provide a more immediate path to capitalizing on the surging demand for semiconductors.

Over the last year, the semiconductor sector has seen a flurry of merger and acquisition activity, with global deals exceeding $31 billion. This sale, if it materializes, would be the continuation of a larger trend in the industry, emphasizing the pivotal role that semiconductors will play in the development of AI and advanced computing technologies.

As these discussions unfold, the implications of such a transaction could reverberate throughout the technology sector, reshaping competitive dynamics and potentially leading to new innovations that will define the future of computing.

Reflecting on this, investors and industry observers would do well to keep a close eye on how this situation develops—especially as the demands of the AI revolution reshape the very fabric of the semiconductor industry.