Market Movements Sparked by Incoming Administration’s Comments: What Investors Should Know

As the finance world braces itself for the impact of a new administration, Donald Trump’s pre-inauguration remarks have already begun shaping stock market trends across various sectors. Investors should pay close attention, as these fluctuations could signal potential opportunities or risks in the months ahead.

Wind Energy Under Pressure

In a surprising statement, Trump indicated his intention to halt the construction of new wind farms during his anticipated second term. This declaration led to notable sell-offs in renewable energy stocks, particularly those tied to wind energy. Key players like Orsted A/S, Siemens Energy AG, and Vestas Wind Systems A/S all saw declines exceeding 6%. For investors focused on renewable energy, this shift could signal the need for a reevaluation of their holdings, especially in light of long-term trends favoring clean energy.

Defense Stocks on the Rise

Conversely, defense contractors have seen a boost in their stock prices due to Trump’s call for NATO allies to increase defense spending to 5% of their GDP—more than double the existing goal. Notable gains were observed in companies such as Kongsberg Gruppen ASA, which rose by 4.1%, and Saab AB, which jumped 5.4%. This may open the door for potential investments in the defense sector as geopolitical tensions continue to drive military spending, presenting a compelling opportunity for those looking to diversify their portfolios.

Tariffs and Trade Wars

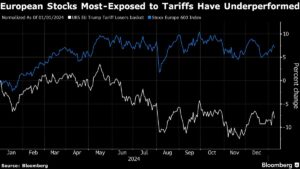

In contrast, comments regarding a potential national economic emergency to implement universal tariffs inflicted pain on automakers and luxury goods companies. Notably, Stellantis NV, the manufacturer of Fiat and Alfa Romeo, fell by 3.1%, and LVMH, the luxury powerhouse behind Louis Vuitton, dropped by 2.2%. The concern over tariffs has weighed heavily on European stocks, particularly those exposed to international trade.

Investors should stay vigilant, as historical patterns show that trade wars can create substantial volatility in the market. The recent performance of a UBS Group AG index tracking European stocks vulnerable to tariffs—down approximately 8%—highlights the pressures these companies are under. A strategic assessment on how such policies could impact profitability is paramount.

Global Market Ripple Effects

Trump’s comments have not just influenced U.S. markets; their effects extend globally. For instance, Australian miner Energy Transition Minerals surged by 52% following Trump’s expressed interest in acquiring Greenland. This demonstrates the sometimes unpredictable and far-reaching consequences of U.S. political rhetoric on foreign markets.

Navigating Uncertainty

According to a recent note from CIC Market Solutions, questions linger about Trump’s future trade and foreign policies, producing uncertainty while he prepares to assume office. This volatility is a reminder to investors that proactive planning and a flexible investment strategy are more critical than ever during times of political transition.

What’s Next?

As we head into the inauguration, stakeholders must remain alert to the potential shifts in policy and their implications for different sectors. Evaluating risk exposure—especially regarding your investments in renewable energy, defense, and international trade—could enhance your strategy in navigating these uncertain waters.

In summary, the upcoming months may present both challenges and opportunities for savvy investors willing to engage with the market dynamics instigated by changes in the U.S. political landscape. Staying informed and adaptable is key to capitalizing on the evolving financial environment.