Tech Stocks Surge: Nvidia Powers Ahead in 2025

The past year has been a remarkable ride for technology stocks, with broader market indices reflecting this enthusiastic momentum. The S&P 500 surged by an impressive 23%, while the Nasdaq Composite climbed even higher, gaining an impressive 29%. One of the standout players in this surge has been Nvidia, a semiconductor titan whose innovations in artificial intelligence (AI) have captivated investors and analysts alike.

Nvidia: The Crown Jewel of AI Stocks

In particular, Nvidia has cemented its position as a leader in the burgeoning AI landscape. The stock has not only become a top gainer within the market but also within the esteemed Dow Jones Industrial Average. Over the past year, Nvidia added an astounding $2.1 trillion to its market capitalization, making it one of the most valuable companies globally. While some may speculate a potential pullback after such explosive growth, analysts, including Dan Ives from Wedbush Securities, suggest that Nvidia still has plenty of upward momentum. We at Extreme Investor Network are aligned with this perspective and see significant growth potential ahead for 2025.

Catalyst for Future Growth: GPUs

Nvidia’s ascent can primarily be attributed to its dominant position in the graphics processing unit (GPU) market. This technology is absolutely crucial for developing and deploying generative AI applications. Currently, Nvidia holds an estimated 90% of the GPU market share, thanks to its broad assortment of advanced chipsets that have effectively set it apart from competitors such as Advanced Micro Devices (AMD).

Boosting Innovation Through R&D

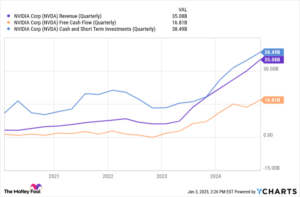

Nvidia’s market dominance has not only generated robust revenue and profit growth but has also fueled further innovation through substantial investments in research and development (R&D). Emerging on the horizon is Nvidia’s next-generation GPU architecture, Blackwell, which has reportedly sold out for the next year. This innovation indicates not only a strong demand for Nvidia products but also the company’s commitment to pushing the boundaries of technology.

To further capitalize on this influence, Nvidia is strategically investing in AI infrastructure. It has set its sights on the burgeoning AI capital expenditure landscape, projected to exceed $1 trillion in the coming years. Recent investments in European GPU cluster specialist Nebius and the acquisition of AI infrastructure firm Run:ai for approximately $700 million illustrate Nvidia’s commitment to maintaining its leading edge.

Analyzing Nvidia’s Valuation: Is It a Buy?

Understanding Nvidia’s valuation metrics is crucial when considering an investment. As of early January 2025, here are some key metrics:

| Valuation Metric | Value as of Jan. 3 |

|---|---|

| Price-to-Earnings (P/E) Ratio | 56.7 |

| Forward P/E Ratio | 48.8 |

| Price-to-Free Cash Flow (P/FCF) | 63.4 |

| Price/Earnings-to-Growth (PEG) Ratio | 1.0 |

At first glance, these metrics may suggest that Nvidia is overpriced. However, it’s essential to note that the P/E and P/FCF ratios have actually decreased compared to last year. This recession in valuation appears to make Nvidia a more attractive investment opportunity, particularly given its accelerating profit growth.

A PEG ratio of 1 signals that Nvidia could be fairly valued at this point, but predicting future earnings as new products and infrastructure investments materialize can be quite complex.

Looking Ahead: The $4 Trillion Club

We foresee that Nvidia has the potential to break into an elite category this year: the $4 trillion club. For growth investors and AI enthusiasts, this stock is a compelling buying opportunity right now. The landscape is shifting rapidly, and Nvidia stands to capitalize on its pioneering position in AI technology.

A Cautionary Note for Potential Investors

Before making any investment in Nvidia, it’s essential to consider alternative recommendations. For instance, the Motley Fool Stock Advisor recently highlighted ten stocks projected to yield substantial returns, none of which include Nvidia. While past performance (such as a hypothetical $1,000 investment in Nvidia in 2005 yielding $885,388 today) may be enticing, savvy investors should always remain informed of diverse opportunities.

Conclusion

Nvidia represents an exciting frontier in technology and investment, particularly in the growing AI landscape. With its innovations, stringent focus on R&D, and strategic investments, the company’s potential for growth in 2025 appears robust. However, as always, a prudent investor should weigh all their options and stay alert to the dynamic market trends shaping our financial future. If you’re looking to stay ahead of the curve, consider following our insights at Extreme Investor Network for the latest developments in finance and investment strategies.