The American Political Landscape: An Essential Analysis for Investors

In today’s tumultuous political climate, the intertwining of governance and investor sentiment is more pronounced than ever. At Extreme Investor Network, we recognize that understanding these dynamics is crucial for making informed financial decisions. Recent discussions in Washington, D.C. hint at an escalating conflict regarding the 2020 election certification, which could have far-reaching implications for markets and the economy.

A Transaction of Trust: The Certifying the Vote Dilemma

Reports have emerged that some Democrats are questioning the certification of the 2020 election results, with arguments surfacing about Vice President Kamala Harris’s role in certifying the Electoral College count. Speculation points to a potentially significant constitutional crisis. Could a protracted battle among Congress members inhibit the swearing-in of a speaker, creating a legislative deadlock that prevents the certification of the election results on January 6?

Such a scenario is not just a theoretical exercise—its implications for market stability are profound. Without a clear electoral outcome, investor confidence may wane, leading to market volatility and potential downturns. Here at Extreme Investor Network, we constantly stress the importance of geopolitical stability in ensuring a robust economic environment.

The Supreme Court’s Stance: A Double-Edged Sword

The Supreme Court’s recent decision not to expand on the eligibility question regarding former President Donald Trump under the 14th Amendment has further complicated the issue. By sidelining this topic, the Court has effectively kept the door open for arbitrary political maneuvering, which could destabilize trust in future elections. Investors must remember that political uncertainty often leads to market underperformance.

As the situation evolves, it’s essential to keep an eye on how these legal battles play out and what that means for broader economic stability. Given the historical context—such as the Court’s earlier decisions affecting electoral outcomes—there’s a clear precedent for significant market impacts stemming from political confrontations.

A Looming Panic Cycle

At the intersection of politics and finance, we find ourselves on the brink of what our computer models predict could be a significant Panic Cycle beginning January 6. Volatility is poised to rise sharply, with a Directional Change forecasted for that week. This combination poses not just a potential constitutional crisis but suggests that markets may react dynamically to unfolding events.

A Call for Vigilance

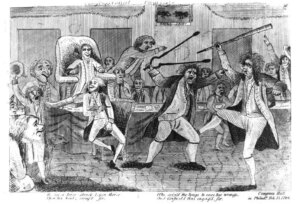

The last significant disruption on Congress’s floor occurred in 1798, reminding us that political strife can have tangible consequences on governance and governance can significantly impact markets. Should turmoil descend upon the Capitol, one can expect a surge in viewership of congressional proceedings—perhaps even surpassing mainstream media coverage.

At Extreme Investor Network, we emphasize the importance of remaining vigilant and well-informed during such critical junctures. Understanding the implications of political strife—and preparing our investment strategies accordingly—will be essential as we navigate these uncertain waters.

In summary, as the political narrative unfolds, so too does the potential for economic ramifications that can impact your portfolio. Stay tuned with Extreme Investor Network for real-time insights and analyses that matter most to your investment strategy. Together, we can navigate these challenging, yet opportune times.