Quantum Computing Stocks: A Divining Rod for Future Investment Success?

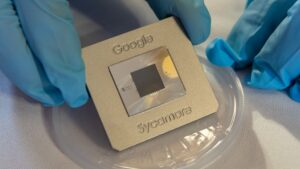

As 2023 comes to a close, one of the hottest topics on Wall Street is none other than quantum computing. Following Google’s recent announcements regarding their Willow chip, which promises exponential error reductions while scaling up qubit usage, we’ve seen a dramatic rally in quantum computing stocks. The excitement around this emerging technology has many investors speculating: Is this the next big thing, or simply a flash in the pan?

Riding the Quantum Wave

Stock prices for pivotal companies in the quantum computing sector have skyrocketed in response to these developments. Rigetti Computing, IonQ, and D-Wave Quantum, among others, have seen their shares soar—Rigetti alone has seen a jaw-dropping 272% increase this month and over 1,000% year-to-date. The Defiance Quantum ETF (QTUM) has also been on a tear, up 52% in 2023. However, before you dive headfirst into this sector, it’s essential to understand that while the gains are alluring, they may also be accompanied by significant risks and uncertainties.

Why Now?

The frenzy surrounding quantum computing can be traced back to the explosive growth of artificial intelligence (AI). With the advent of AI tools like ChatGPT, investors have been eagerly searching for the next technological leap. Quantum computing holds the promise of immense computational power that could revolutionize various industries, offering solutions for complex problems unreachable by classical computers. But therein lies the question: Are we truly ready to adopt and utilize this powerful technology?

The Wait for Real-World Applications

While the talk of quantum computing has been prevalent for at least a decade, the consensus among industry experts is that we are still years, if not decades, away from realizing its full potential. Paul Meeks, Chief Investment Officer at Harvest Portfolio Management, aptly stated, "Any kind of evidence that impacts financials is way, way, way out in the future." Many analysts are wary, suggesting that solid, profitable use cases will not materialize until around 2026 or 2027.

A Wall of Caution

Given the hype, it’s not surprising that many professionals are cautious. Anjali Bastianpillai, a senior client portfolio manager at Pictet Asset Management, warns that current investments in quantum computing are still primarily in the private sector, making precise valuations challenging. Recent public offerings through SPAC mergers have many portfolio managers wary, drawing parallels to the spike in AI stocks that ultimately led to several disappointing investment outcomes earlier this year.

“This whole quantum group is in the speculation overexuberance stage,” says Ted Mortonson, Baird’s technology desk sector strategist. It’s a crucial point to keep in mind. Investing purely based on trends without a firm grounding in real-world applications and financial fundamentals can lead to pitfalls.

Strategies for Quantum Investment

So, what’s a savvy investor to do? Given the uncertainty surrounding pure-play quantum stocks, one prudent strategy is to gravitate toward established mega-cap companies that dominate other sectors while investing in quantum initiatives. These firms often possess considerable free cash flow and robust business models, offering a layer of stability absent in smaller, speculative names.

Tech giants like Alphabet, Amazon, and Microsoft are already integrating quantum computing into their long-term strategies while maintaining significant leadership in digital advertising and cloud computing. Investors seeking exposure to quantum technology without diving into risky stocks should consider these established companies, which have proven track records and diversified revenue streams. Alphabet’s shares are up 40% this year, reinforcing its position as a tech powerhouse with added quantum potential.

The Future of Quantum Computing

While the immediate future of quantum computing stocks remains shrouded in uncertainty, it’s clear that investors should approach with caution and strategy. The allure of quick gains may be strong, but grounding your investments in companies with stable financial fundamentals can provide an essential buffer against the whims of market speculation.

As the tech landscape continues to evolve, the Extreme Investor Network is committed to providing insights and analysis that empower our readers to make informed investment decisions. Keep a close watch on quantum developments over the next few years; the future—while uncertain—holds remarkable potential for those prepared to navigate its complexities.