Market Insights: Analyzing Pressure on Treasuries Amid Economic Shifts

In recent trading sessions, U.S. Treasuries have faced increased pressure, particularly in a holiday-shortened environment where investor sentiment leans towards caution. The allure of parking cash in long-term U.S. government debt, particularly those bonds maturing in a decade or longer, is waning for many market participants.

Yield Trends Indicating a Shift

On Tuesday, the yields on long-term debt instruments exhibited a notable uptick, contributing to a steepening yield curve — a pattern that has characterized recent market dynamics. Benchmark 10-year yields rose to approximately 4.62%, marking an increase of about three basis points. Meanwhile, the gap between two-year and 10-year securities widened by as much as 28 basis points, nearing levels not seen since 2022. With trading volumes reduced to about 50% of typical levels, the market is presenting a unique landscape for investors.

Federal Reserve’s Role and Potential Economic Policies

Several factors are influencing this cautious stance, notably speculation surrounding the Federal Reserve’s future monetary policy. There’s an increasing expectation that the Fed may conclude its current easing cycle at more elevated levels than earlier predicted. This sentiment is coupled with anticipated economic growth and inflationary pressures linked to President-elect Donald Trump’s proposed agenda. Such changes may adversely affect the U.S. fiscal landscape, further dampening demand for long-term government debt.

Options traders are responding to these dynamics by positioning themselves to capitalize on potentially rising yields, underscoring the market’s anticipatory nature.

Expert Insights

Tom di Galoma, head of fixed income at Curvature Securities, suggests that we are indeed in a rising interest rate environment, predominantly influenced by long-term bonds. He notes, “There’s a lot of concern about what the next administration will be doing and how it impacts where rates go.” The projection is that the 10-year yield could target a support level around 5% in the near future, with expectations that the spread between two-year and ten-year yields may reach 50 basis points as early as next year.

Performance Metrics

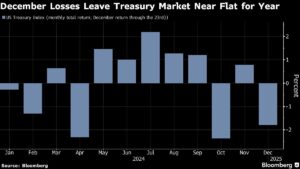

The predicament for Treasuries has become more pronounced, evidenced by a 1.8% decline this month, which brings this year’s overall gains down to a mere 0.3%. To put this in perspective, yields had risen robustly earlier in the year, reaching an impressive 4.6% increase until mid-September when the Fed commenced its rate-cutting cycle. The losses experienced last year, where Treasuries yielded just 4.1%, came on the heels of declines of 12.5% in 2022 and 2.3% in 2021 — illustrating a volatile trajectory for bond investors.

Auction Activity and Market Behavior

Despite the current challenges, the U.S. Treasury market continues to see strong demand, with a $70 billion sale of five-year notes recently attracting considerable interest. This was followed by a well-received auction of two-year securities. Looking ahead, a sale of $44 billion in seven-year notes is scheduled, which could offer additional opportunities for investors.

As trading was curtailed ahead of the Christmas holiday, the Securities Industry and Financial Markets Association recommended an early close for the cash bond market, further signaling the effects of seasonal investor behavior on trading volume.

Future Considerations

Looking toward 2025, swaps traders are anticipating about 0.33 percentage points of Fed rate cuts, which is below the two quarter-point reductions projected by Fed officials. The landscape remains complex for investors; with a slim Republican majority in both the U.S. House and Senate, the enactment of Trump’s policies remains uncertain. This ambiguity leaves many investors hesitant to make aggressive bets in the current market environment.

Julian Potenza, a portfolio manager at Fidelity Investments, encapsulates the prevailing sentiment when he states, “There’s a lot of uncertainty, kind of uncertainty upon uncertainty. Respecting that, we’re not taking any big active bets relative to benchmark right now.”

Conclusion

As we navigate these shifting tides in the market, understanding the implications of interest rate movements and economic policies becomes crucial. Staying informed and adaptable will empower investors to make strategic decisions in an environment that is both volatile and promising. For in-depth analysis and the latest updates on the financial markets, keep connected with us at Extreme Investor Network to gain insights that matter for your investment strategy.