The 2024 Crypto Landscape: Solana vs. Bitcoin

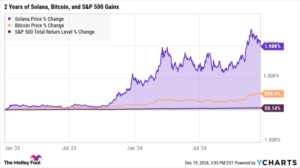

In 2024, the S&P 500 has recorded a remarkable total return of 25%. While this is indeed a stellar performance for traditional equities, it pales in comparison to the explosive growth witnessed in the cryptocurrency market. At the end of 2023, the combined market value of all cryptocurrencies was approximately $1.65 trillion. Fast forward to December 19, and this figure doubled to an astonishing $3.30 trillion—a testament to the crypto market’s resilience and speed of recovery.

Stellar Performers in Crypto

Among the crypto titans, Bitcoin (BTC) has established itself as a pioneer, boasting a gain of 138% over the same timeframe. Equally impressive, Solana (SOL) has surged 101%, positioning itself as a formidable player in the realm of smart contracts. However, it’s crucial to zoom out for a more comprehensive perspective. Since December 2022, Solana has experienced an astronomical 2,000% price increase, substantially outpacing not just Bitcoin but also traditional stock indices.

Despite a recovery propelled by a historically low starting price—plummeting from $259 to around $10 amid the FTX fallout—Solana is now rebounding strongly. This meteoric rise serves as both a beacon of hope and a cautionary tale, reminding investors that dazzling returns often stem from starting points devastated by market turmoil.

The Future of Solana

There’s much optimism surrounding Solana as it re-establishes itself within the top ten cryptocurrencies. Its robust network execution allows for high-speed smart contracts, which are particularly beneficial in high-volume environments such as mobile gaming and real-time trading platforms. The potential for everyday transactions, perhaps even purchasing necessities like gas or groceries, positions Solana as a versatile contender in the crypto ecosystem.

Why You Should Consider Solana Now

Investors should ponder whether this is the right moment to diversify their crypto portfolio by reallocating from Bitcoin to Solana. The ongoing evolution of the cryptocurrency landscape suggests that Solana may play an increasingly significant role in practical applications.

Yet, while Solana garners attention, it’s pertinent to remember Bitcoin’s longstanding advantages and the catalysts that continue to propel its growth:

-

Halving Events: Bitcoin undergoes a halving roughly every four years, a process that reduces the reward for mining new blocks, thereby influencing supply and, historically, price gains in subsequent years.

-

Crypto ETFs: The advent of exchange-traded funds (ETFs) based on Bitcoin provides traditional investors easier access to crypto exposure, potentially drawing in new capital and stabilizing the market.

- Political Landscape: The recent political climate in the U.S. hints at a more crypto-friendly regulatory framework. Anticipated policies may include the establishment of a national Bitcoin reserve, which would further enhance Bitcoin’s scarcity.

A Balanced Investment Approach

While Solana’s remarkable surge is noteworthy, Bitcoin’s legacy and ongoing development present a compelling case for its long-term viability. A strategy of holding a larger proportion of Bitcoin alongside a smaller speculative investment in Solana may offer a balanced approach.

Investing in cryptocurrencies carries inherent risks, and while Solana might appeal to those in search of rapid gains, Bitcoin has demonstrated its potential as a more stable asset, often referred to as "digital gold."

Actionable Insights for Investors

Before making any investment decisions, consider the broader market context and your financial goals. Diversification remains a cornerstone of any prudent investment strategy. While Solana represents the thrill of high-risk, high-reward investing, Bitcoin has steadily transitioned into a value-holding asset—an anomaly in the typically volatile crypto space.

As you contemplate your next move in the crypto market, remember to balance your portfolio thoughtfully. For those serious about capitalizing on significant market opportunities, exploring traditional stocks might also provide an avenue for impressive returns in conjunction with crypto holdings.

In conclusion, whether your focus leans more towards Bitcoin’s stability or Solana’s potential, one fact remains clear: Both cryptocurrencies offer distinctly unique advantages that investors can leverage according to their individual risk appetites and investment goals. And in an ever-evolving financial landscape, staying informed is your greatest ally.