Walgreens Boots Alliance: A Maligned Giant or an Unmissable Opportunity?

Walgreens Boots Alliance (NASDAQ: WBA) has long been a staple name in the healthcare and pharmacy sector, serving communities across the globe. For generations, customers have turned to their local Walgreens to fill prescriptions and purchase everyday items. However, this reputable brand currently faces compelling challenges that have dramatically affected its market performance.

The Hard Reality: A Dramatic Stock Decline

Unfortunately, in recent years, Walgreens has suffered significant pitfalls. The company’s aggressive expansion strategies have strained its financial structure, triggering a staggering 90% drop in stock valuation since its peak. These enterprise-level decisions have led investors to question if Walgreens can recover and reclaim its former glory.

Turning Points: A Ray of Hope Amid Challenges

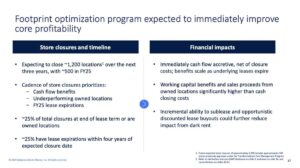

In light of these struggles, the current management team has enacted a turnaround plan focusing on debt reduction and cost trimming. By eliminating unprofitable outlets and streamlining operations, Walgreens aims to stabilize its balance sheet, with a glimpse of optimism for a rebound in earnings growth. As it stands, Walgreens offers a dividend yield of approximately 11%, attracting investors who see potential in this beleaguered stock.

But is this inherent optimism justified? Or is Walgreens a relic of an industry grappling with evolving consumer behavior and competition?

The Value Proposition: Pharmacy Reinvented

Walgreens Boots Alliance is a heavyweight within the pharmacy space, recognized as one of the largest pharmacy companies globally. Ironically, while customers often visit for prescription medications, these sales are merely a gateway to broader retail offerings. The company’s razor-thin profit margins in pharmaceuticals mean that retail items like snacks and household goods largely fuel profitability. Just recently, Walgreens generated nearly $116 billion in revenue in the U.S., yet its operating income was only around $2.1 billion, reflecting a meager 1.5% margin.

The intense competitive landscape has compelled pharmacy giants, including CVS Health—with its acquisition of Aetna—to seek diversification. Walgreens, instead, has ventured into patient care services, a strategy marked by complex acquisitions and rising costs, ultimately overburdening its finances.

Signs of Recovery?

As Walgreens trims its operations to regain footing, recent financial projections indicate that the worst may be behind them. Although earnings for 2025 may dip to as low as $1.40 per share, analysts predict a promising average growth of 5% annually over the next three to five years. This could point toward a gradual return to profitability.

With a forward P/E ratio hovering around 6 and a PEG ratio of 1.1, Walgreens appears undervalued at face value. Upward trends in earnings, coupled with the current dividend yield, could deliver an attractive total return of around 16% annually for savvy investors willing to navigate the risks.

The Dividend Dilemma: Is the Yield Sustainable?

The dividend yield becomes crucial here, as it significantly contributes to the anticipated total investment returns. However, it’s important to note that a stock’s dividend yield is a reflection of market confidence; a high yield often signals underlying troubles. Analysts have flagged concerns regarding Walgreens’ current dividend, which stands at $1.00 per share, consuming a staggering 70% of the company’s expected earnings for 2025. Recent earnings calls did not guarantee the maintenance of this dividend, adding another layer of uncertainty.

Challenges Ahead: A Dwindling Business Model?

While the brick-and-mortar model of Walgreens may not vanish overnight, it’s clear that consumer shopping habits are evolving rapidly, with direct-to-consumer shipping emerging as a formidable alternative. As Walgreens continues to shutter less profitable stores, the landscape becomes less favorable for a sizeable rebound. Moreover, credit rating downgrades to speculative status have raised alarms about the potential for a dividend cut, which would likely diminish investor sentiment and exacerbate growth challenges.

Acquisition Rumors: Shifting Terrain

To add to the intrigue, there are whispers that Walgreens may consider being acquired by private equity firms looking to take the company private. Any prospective sale would need to be at a premium to its current valuation. However, given the company’s ongoing struggles, big rewards for shareholders may not materialize.

Final Thoughts: Should You Walk Away?

In conclusion, once a titan in the retail pharmacy world, Walgreens Boots Alliance now finds itself at a crossroads. While the potential for recovery exists, the risk factors are considerable. If you’re eyeing Walgreens as a possible investment, it might be wiser to explore other opportunistic options that can offer better long-term growth prospects and less volatility.

Time to Act: Don’t Miss Your Next Big Chance

If you’ve ever felt regret about missing out on significant investment opportunities, we invite you to consider our “Double Down” stock recommendations from our expert analysts. According to our historical returns, those who acted on our insights have seen extraordinary gains:

- Nvidia (2009): $1,000 invested would have grown to $348,112!

- Apple (2008): A $1,000 investment would now be worth $46,992!

- Netflix (2004): An impressive return of $495,539 from an initial $1,000 investment!

Right now, we’re identifying three companies primed for significant growth, and opportunities like this don’t last. If you want to capitalize on our next predictions before they take off, make sure to dive into our investment strategies today!

See our top “Double Down” stocks for an opportunity you won’t want to miss!