Intel vs. AMD: The Semiconductor Showdown That May Define the Future

In the ever-evolving landscape of semiconductor manufacturing and design, the tides have shifted dramatically in recent months. Once upon a time, I held a bullish stance on Intel (INTC), a leader in the semiconductor space. However, the recent decision by Intel’s board to oust CEO Pat Gelsinger has left me questioning the company’s trajectory and its place in a rapidly changing industry. In stark contrast, Advanced Micro Devices (AMD) is not just surviving, but thriving, showing an impressive momentum backed by strategic management and a strong market position.

Intel’s Leadership Shakeup

On December 1, 2024, Pat Gelsinger was removed as Intel’s CEO—a move that rattled investor confidence. Gelsinger’s ambitious plans, which sought to steer Intel into a critical advanced semiconductor manufacturing space through initiatives like Intel Foundry Services, were met with skepticism. The board was troubled by the slow pace of results in a market dominated by fierce competitors like Nvidia (NVDA), which has an alarming lead over Intel in market valuation. During Gelsinger’s tenure, Intel’s market value plummeted to just 30% of Nvidia’s, resulting in a staggering drop of over 60% in Intel’s stock price.

These figures illustrate the challenges that the company faced, caught between the necessity for immediate returns and the long-term vision required to pivot in a deeply competitive industry. The board’s decision reflects an urgent need to reassess their strategic direction amid escalating pressures, both from competitors and the complexities of Western geopolitical dynamics concerning semiconductor production.

AMD’s Stellar Performance

As Intel grapples with uncertainty, AMD has emerged as a formidable force in the semiconductor sector. The company is witnessing remarkable growth, particularly driven by its Data Center segment, which constituted over half of its total revenue in Q3 2024—marking a staggering 122% year-over-year increase. AMD’s commitment to high-performance computing, AI chip development, and expanding its footprint in gaming and consumer electronics underscores its robust value proposition. Moreover, AMD’s year-over-year EBITDA growth of 47.05% starkly contrasts with Intel’s lackluster 8.76%, showcasing AMD’s operational excellence.

In evaluating growth potential, I project that by December 2026, AMD could achieve approximately $40 billion in total revenue. Coupled with an expected enterprise value of around $340 billion—calculated at a forward EV-to-sales ratio near 8.5—investors could see an impressive 65% total price return in just two years based on our current valuations.

The Risks Ahead

It’s essential to recognize that while AMD appears robust now, the semiconductor market is inherently cyclical. Industry giants like AMD and Nvidia are at risk of valuation corrections in the years ahead depending on how demand from Big Tech for AI infrastructure evolves. Nevertheless, there is currently no sign of a slowdown, and AMD’s proactive approach positions it strongly against any potential headwinds.

Investment Implications

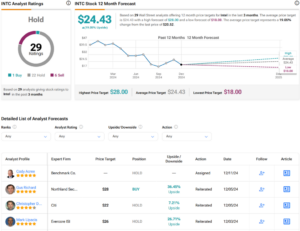

Due to the upheaval within Intel’s executive leadership, my recommendation has shifted from a Buy to a Hold, especially given the lack of semiconductor experience among the new board members. The market consensus for Intel leans towards a Hold, with a marginal upside in price targets; however, the path to recovery looks convoluted at best.

Contrastingly, AMD has been assigned a consensus Moderate Buy rating on Wall Street, with a compelling average price target reflecting a 42.34% upside potential over the next year. AMD’s exceptional management and capitalizing on market demand indicate a much clearer investment case.

In conclusion, while I once considered Intel a frontrunner, the uncertainties surrounding its leadership and strategic focus require a cautious approach. In contrast, AMD’s dynamic growth trajectory and stable management make it a prime candidate for inclusion in my growth portfolio, with a price target of $175 set as a profit-taking point—a figure I anticipate raising as AMD’s position solidifies.

The semiconductor sector is one to watch closely, as the developments and decisions made today could shape the competitive landscape for decades to come. Make sure to stay informed for ongoing insights and strategies tailored to the rapidly evolving investment terrain at Extreme Investor Network.